As output growth continues to slow and borrowing costs rise, the challenge for the industry must be on finding ways of improving productivity, says Kris Hudson.

The new budget announced in November from the UK’s third chancellor in as many months has failed to significantly improve the pessimistic outlook of many market observers. As the country enters recession, the construction sector will need to brace itself, while focusing on long-term investment, maintaining relationships and doing more with less.

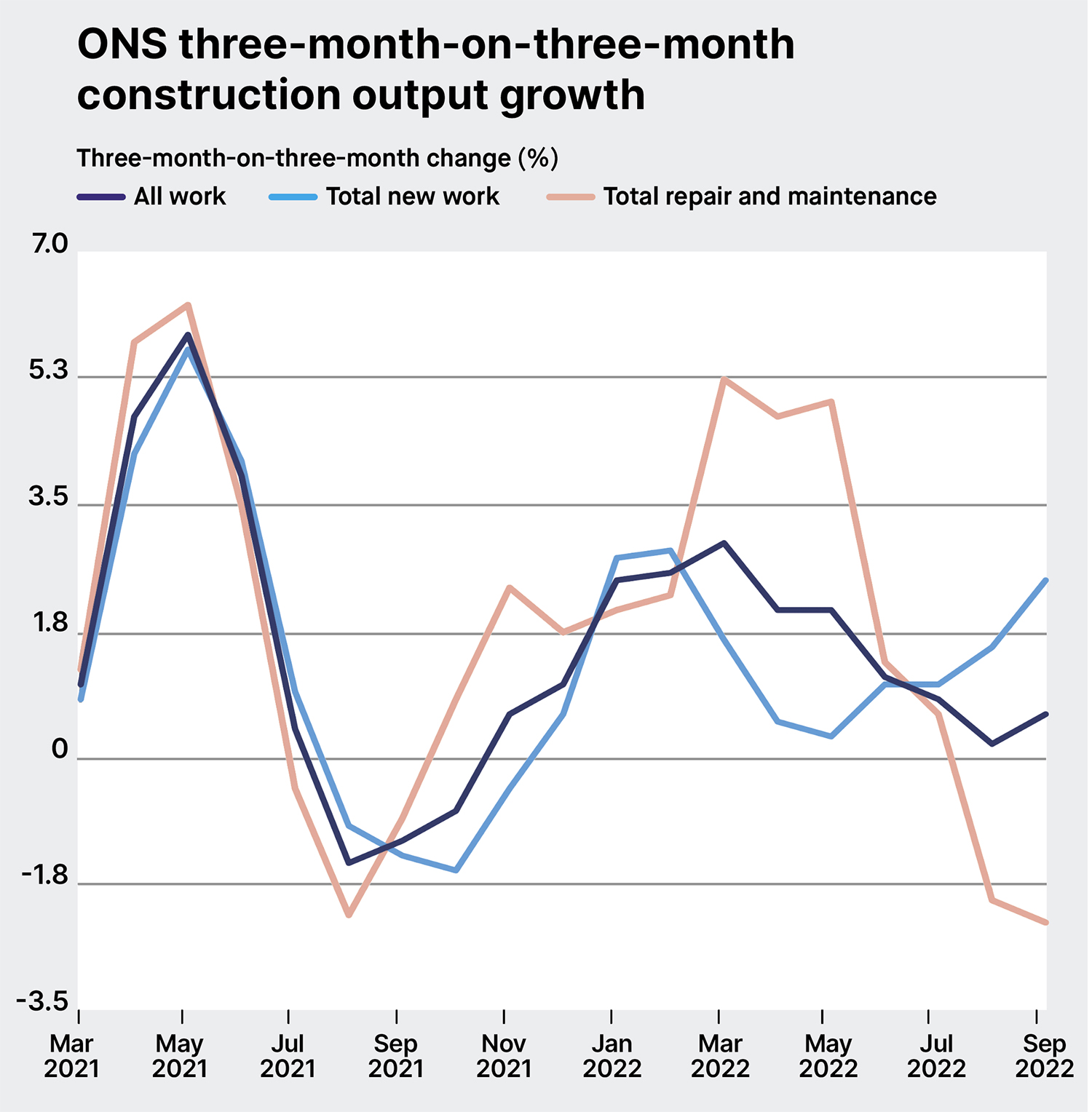

Construction output growth has been slowing since February, with supply chain disruption and inflation continuing to act as a drag on activity levels. Data from the Office for National Statistics shows that all work construction output growth increased by just 0.6% in September 2022, having steadily fallen from 2.9% growth in the three months to March 2022. This has largely been driven by a fall in repair and maintenance work of 2.2% in September 2022, with these works being delayed or halted due to reduced disposable incomes following heightened food and energy costs.

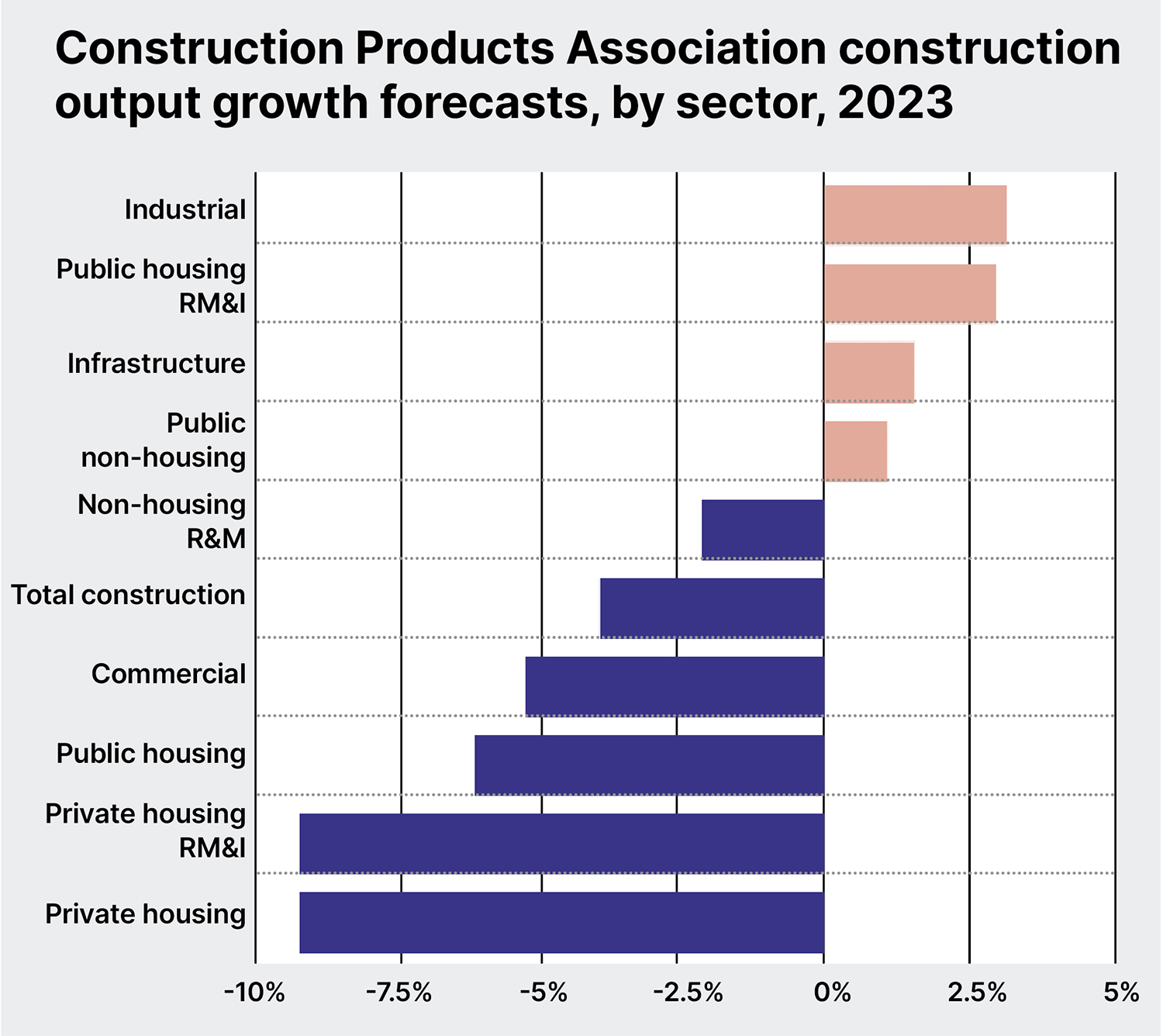

In the face of rising borrowing costs and economic uncertainty, forecasts also offer few causes for optimism when looking at sector-wide data. On average, the latest construction output forecasts suggest that activity may fall by as much as 4.5% in 2023, softening to a 0.3% decrease in 2024.

Register for free or sign in to continue reading

This is not a paywall. Registration allows us to enhance your experience across Construction Management and ensure we deliver you quality editorial content.

Registering also means you can manage your own CPDs, comments, newsletter sign-ups and privacy settings.