All eyes on employment – industry capacity will be critical to a healthy recovery, says Kris Hudson

This autumn will be a critical juncture for the UK construction industry. With the plug about to be pulled on the government’s Job Retention Scheme (JRS), there may be significant and long-term repercussions on employment in the sector.

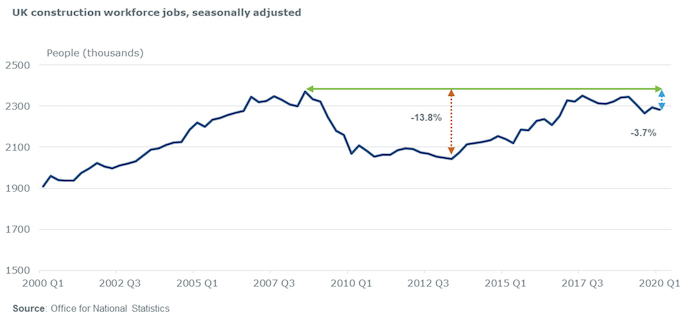

As of Q1 2020, construction workforce jobs remained -3.7% below the peak seen prior to the 2008/09 recession. In simple terms, jobs that were cut directly after the global financial crisis still had not returned before the covid-19 recession gripped the UK.

The most recent data from the Office for National Statistics showed that 11.5% of the construction industry remained on partial leave or furlough during the period from 10 August to 23 August 2020.

This is positive, and fairly low by comparison to many other industries, but we should be concerned by the potential rollover effect on construction employment.

If those roles still on furlough eventually translate into redundancies as the JRS tapers off, industry capacity and capability may be reduced and materially lowered. Ultimately, this can have a significant knock-on for industry pricing.

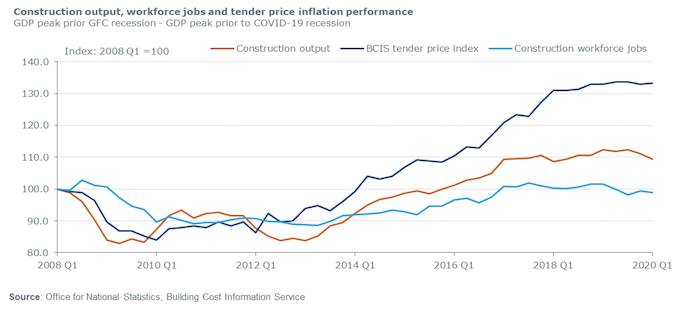

In the last recession output dropped, contractors bid low to lock in turnover and construction employment belatedly fell as workloads diminished. This is because employment reacts slowly to changes in demand, partly due to unions and contracts.

After construction output started to accelerate from 2013 Q1, employment and pricing diverged. Tender price inflation increased by 39.3% over the next five years as workloads increased and employment levels remained stubbornly low. Companies hesitated when making hiring decisions, fearful that green shoots of recovery may not take root, and jobs growth increased by just 13% in comparison.

This is important because construction workers are ultimately the lifeblood of the industry. Any squeeze on industry capacity or capability can contribute to upwards pressure on pricing. A rise in redundancies following the closure of the furlough scheme could therefore be hugely significant, tempering tender price reductions in the short term, but exacerbating increases in the long term.

As the government switches off the life-support machine, it is not just contractors that need to understand how their headcount may be affected. Investors, suppliers and asset owners will need to keep a very close eye on their supply chain for signs of instability that could impact the whole sector.

Kris Hudson is an economist and associate director at Turner & Townsend