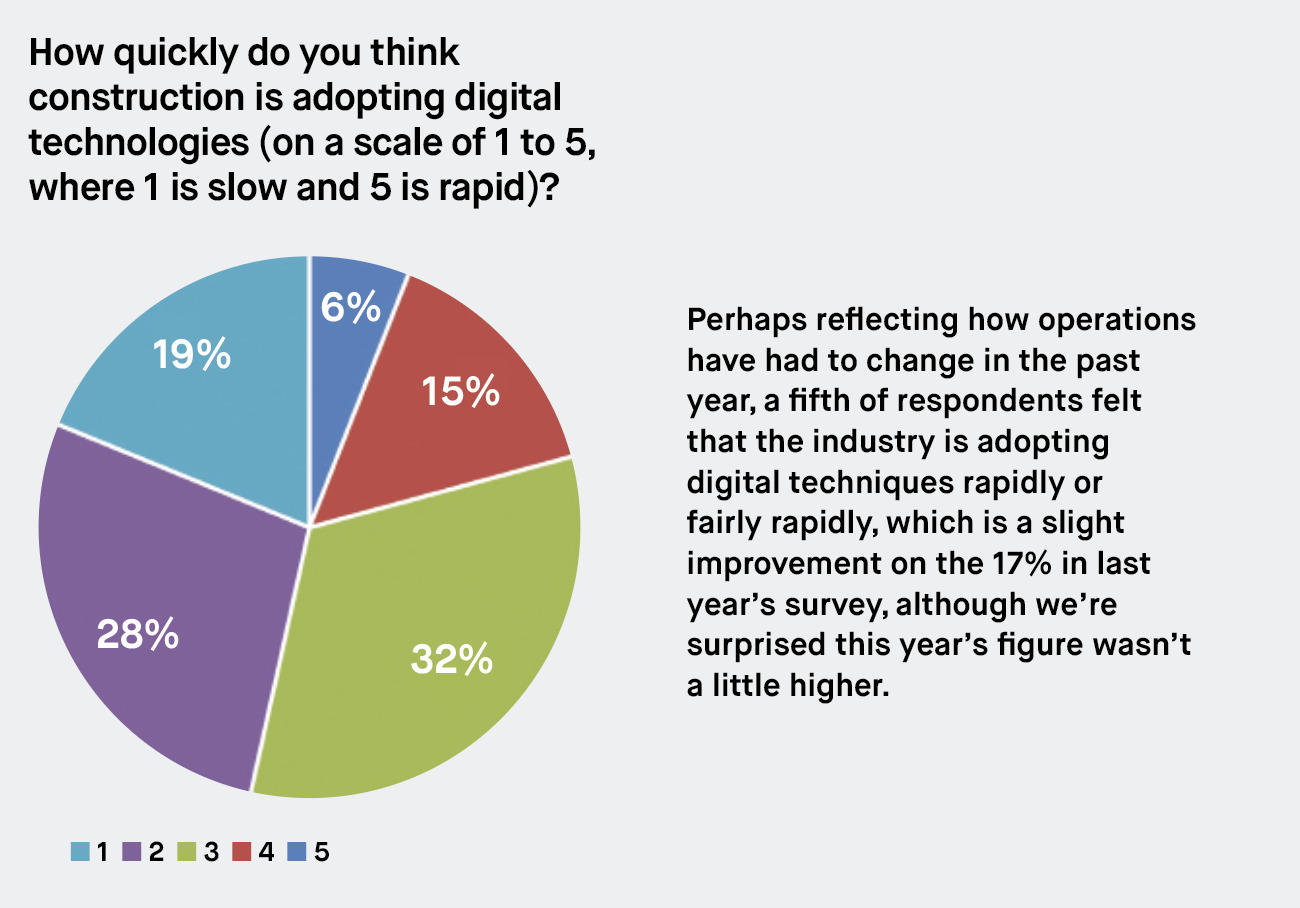

The year of working remotely has led to greater adoption of digital technologies, but not as quickly as might have been expected, as the annual CM and BIMplus survey demonstrates

A year of operational restrictions and working remotely due to covid has undoubtedly resulted in an increase in the adoption of BIM and digital technologies, but critical mass is still some way off.

That’s the overview provided by the annual Construction Manager BIM survey, in conjunction with BIM+, in which nearly 200 construction professionals aired their experiences of BIM and digital technologies.

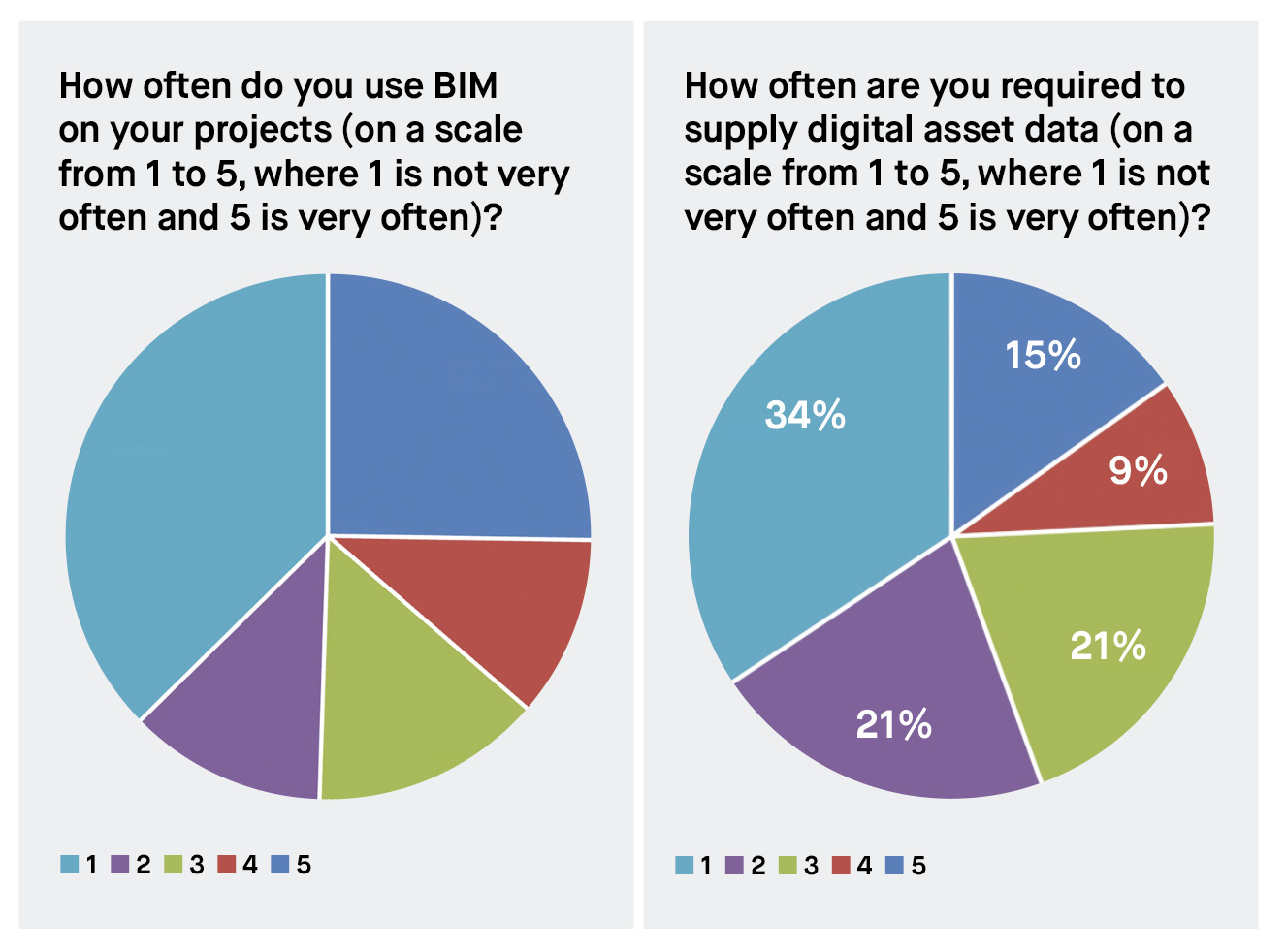

BIM was more frequently used on projects in the past year than the year before – not by much, but by enough to be worthy of note: more than a third of respondents (36% – those scoring four or five on a scale of one to five) said BIM is used very often and fairly often on their projects, up from 34% the year before.

“It seems the ripple effect of the impacts of the pandemic are withering”

There was a similarly small shift in the percentage of respondents either using BIM fairly rarely or very rarely: 52% in 2020 to 49% this year.

We opened out the survey this year, inviting respondents to tell us more about the reasons for their answers. We acknowledge it’s something of a self-selecting exercise: only the most passionate respondents will take the opportunity to air their thoughts,

but those thoughts are still relevant.

Responses veered from the overwhelmingly positive – “we’ve used BIM on every project for the last five years” – to the painful – “never used; it’s a marketing tool used by estimators who pretend to use it to win job”.

The following answer may ring true with many readers: “BIM is used on public sector projects where I am able to convince clients of the benefits, which many are ignorant of. For my private projects, only for high value ones.”

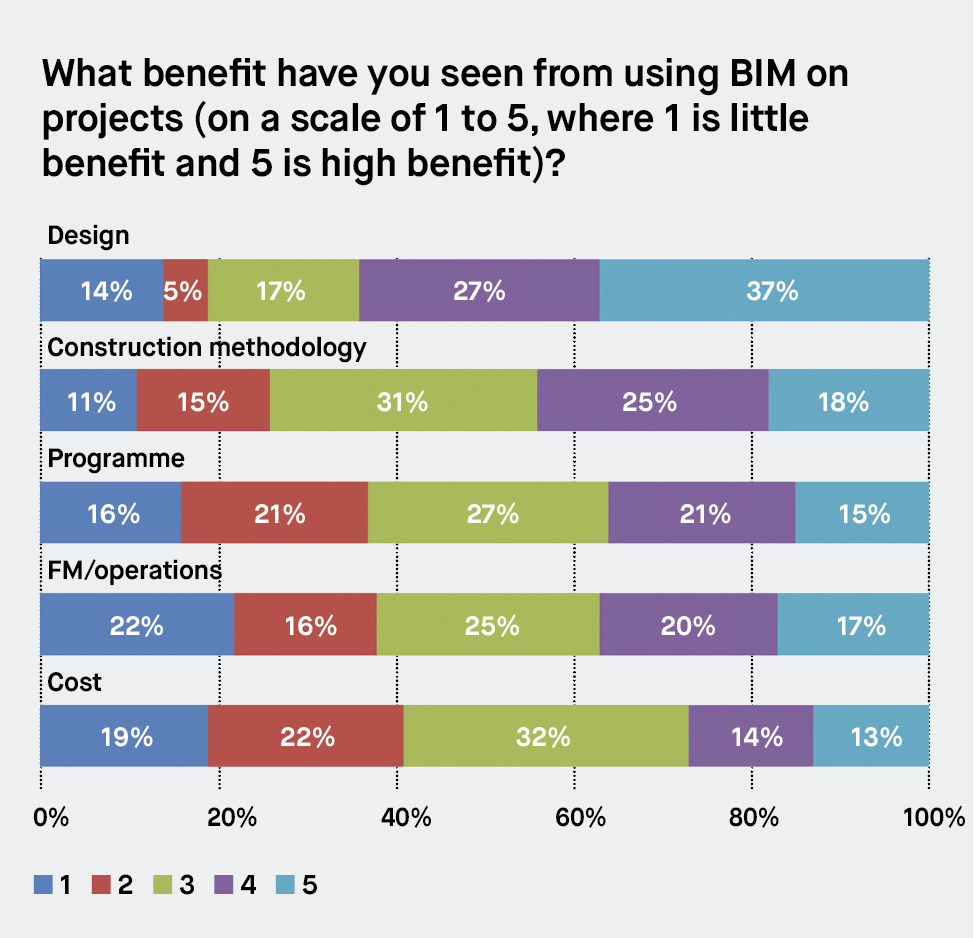

Nevertheless, the positive impact of BIM is being more widely felt: nearly two-thirds (64%) of respondents said they were seeing high or fairly high benefit in design compared to 58% in last year’s survey.

Benefits of BIM

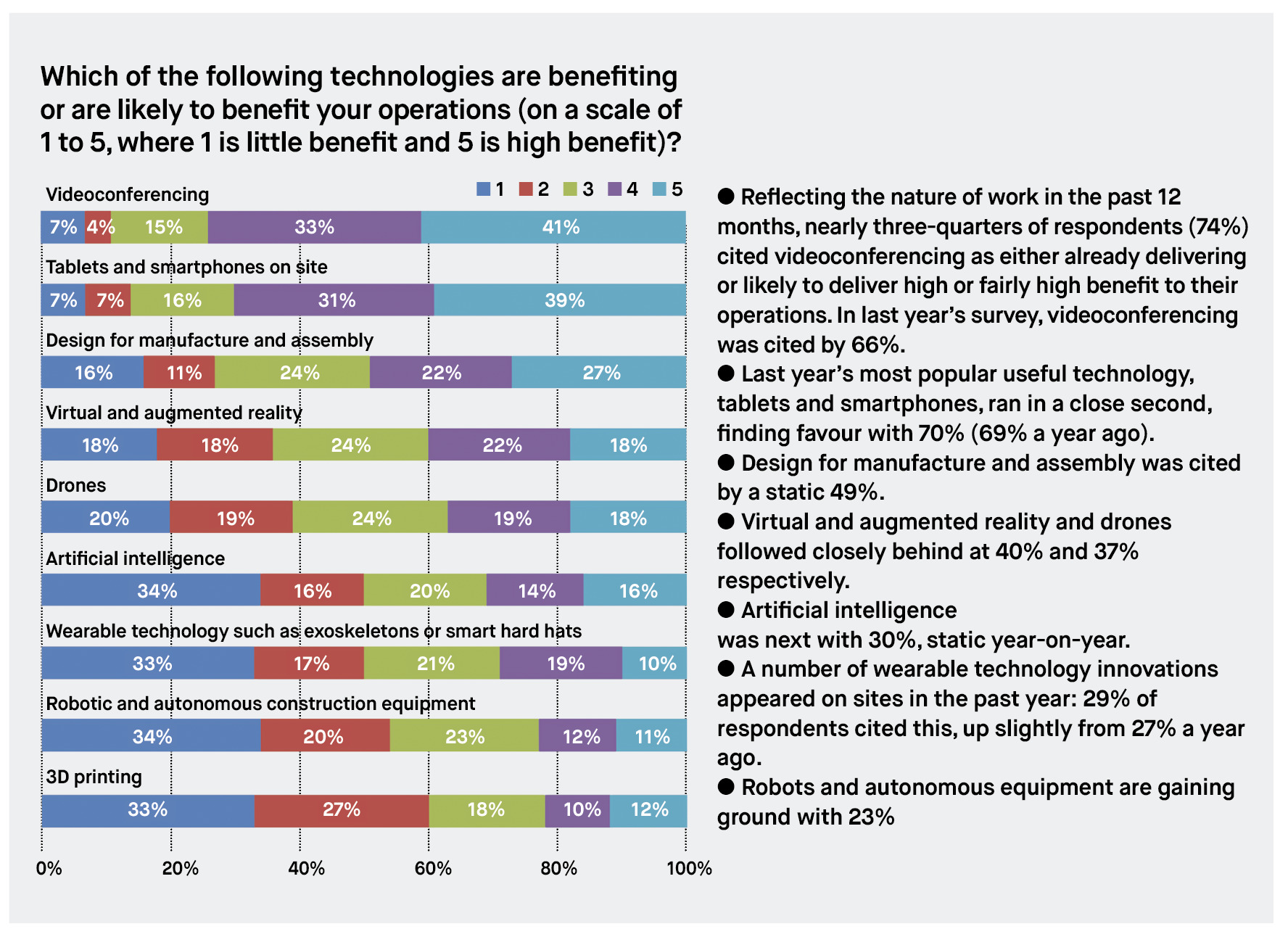

Design is the area that respondents are seeing the most improvement in thanks to BIM. More than a third (43%) also cited benefits in construction methodology (down from 44% last year). Benefits were also apparent in programme (36%, down from 39%), FM and operations (37%, up from 34%), and cost (static year on year at 27%).

A couple of verbatim responses add some colour to these bare statistics.

One respondent, seemingly a BIM advocate, said: “BIM is a great solution for clash prevention, helps hugely in collaboration, provides an opportunity to manage and control costs and prevents waste.”

“BIM lowers the stress levels normally related to traditional methods”

Another said: “Good information management has provided productivity increases, clarity and better quality of work.”

One respondent reported a further, somewhat unexpected, benefit of BIM that is important in light of wider society acknowledgment of the importance of mental health, namely that BIM “lowers [the] stress levels normally related to traditional methods, which cause a lot more stress due to expected problems on the construction site due to clashes or mistakes in traditional 2D drawings between disciplines”.

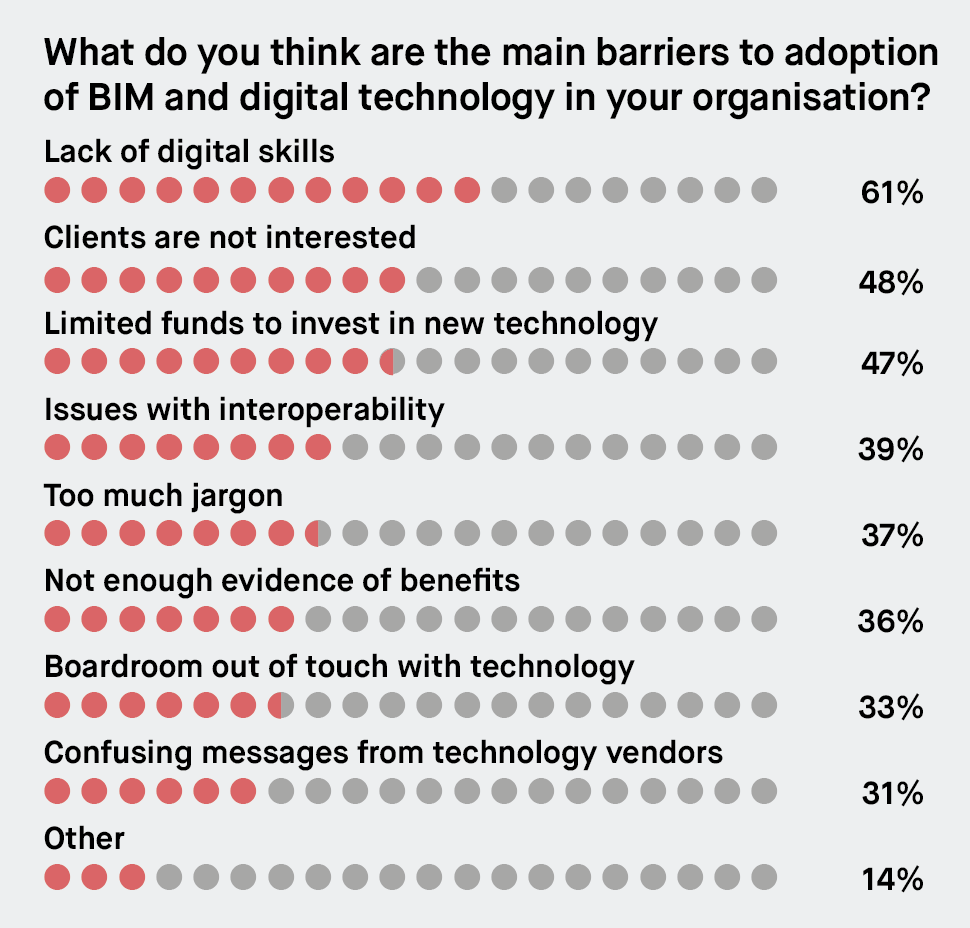

Intriguingly, the lack of evidence of the benefits is less frequently cited as a barrier to the adoption of BIM and digital technology: the percentage of respondents citing lack of evidence as a blocker dropped to 36% from 45% in last year’s survey.

The most prevalent blocker was the same year on year and will come as no surprise: the lack of digital skills, cited by 61% this year (63% a year ago).

“All we want is asset data, but seemingly that attracts a huge bill from the supply chain for the privilege of being passed our own data”

The lack of client interest, at 48%, and limited funds to invest in new technology, at 47% were the next most prevalent.

One respondent told us: “Clients often don’t want to take BIM beyond pre-contract phase as they see it as a cost.”

In contrast, one FM client told us: “All we want [is] asset data, but seemingly that attracts a huge bill from the supply chain for the privilege of being passed our own data. Sorry to seem very cynical, but that is why BIM is not gaining traction with clients.”

This year, we added two new answer options to this question of BIM blockers and they came in fourth and fifth on the list: issues with interoperability (39%) and too much jargon (37%).

Winning over management

The boardroom being out of touch with technology was cited by a third; one respondent said: “Senior leadership is bought in primarily, but mid-level leadership must be educated enough on the sell, delivery and recovery of BIM/virtual design and construction (VDC) to ensure we are compensated on each project. Our primary issues are building an early internal relationship and trust to ensure that VDC is part of the project pursuit strategy and costs are factored in for resources to be deployed later.”

“Some have been getting the rough end of the stick: BIM is treated like a sideshow”

Confusing messages from technology vendors drew the ire of 31%.

Some respondents have been getting the rough end of the stick: “BIM is treated like a sideshow, not part of main project delivery.”

Another said: “There are multiple pain points when adopting digital construction methods and workflows – resistance to change, both by staff ‘at the coalface’ and senior managers is extremely common. Unless frontline workers perceive the benefits of BIM directly, they are not keen to pay more than lip service to digital adoption. Senior management want to have more certainty over costs, and the ‘super-specialism’ of BIM practitioners and vagueness surrounding software product lifecycles tends to obscure this. There is very little chance for the layman to ‘get on board’ as the train has already left the station!”

Possibly as a result of the industry slowdown due to covid and fewer projects completing in the past year, less than a quarter of respondents said they were required to supply digital asset data upon project completion very or fairly often: a small fall from 29% to 24% year on year.

Upholding standards

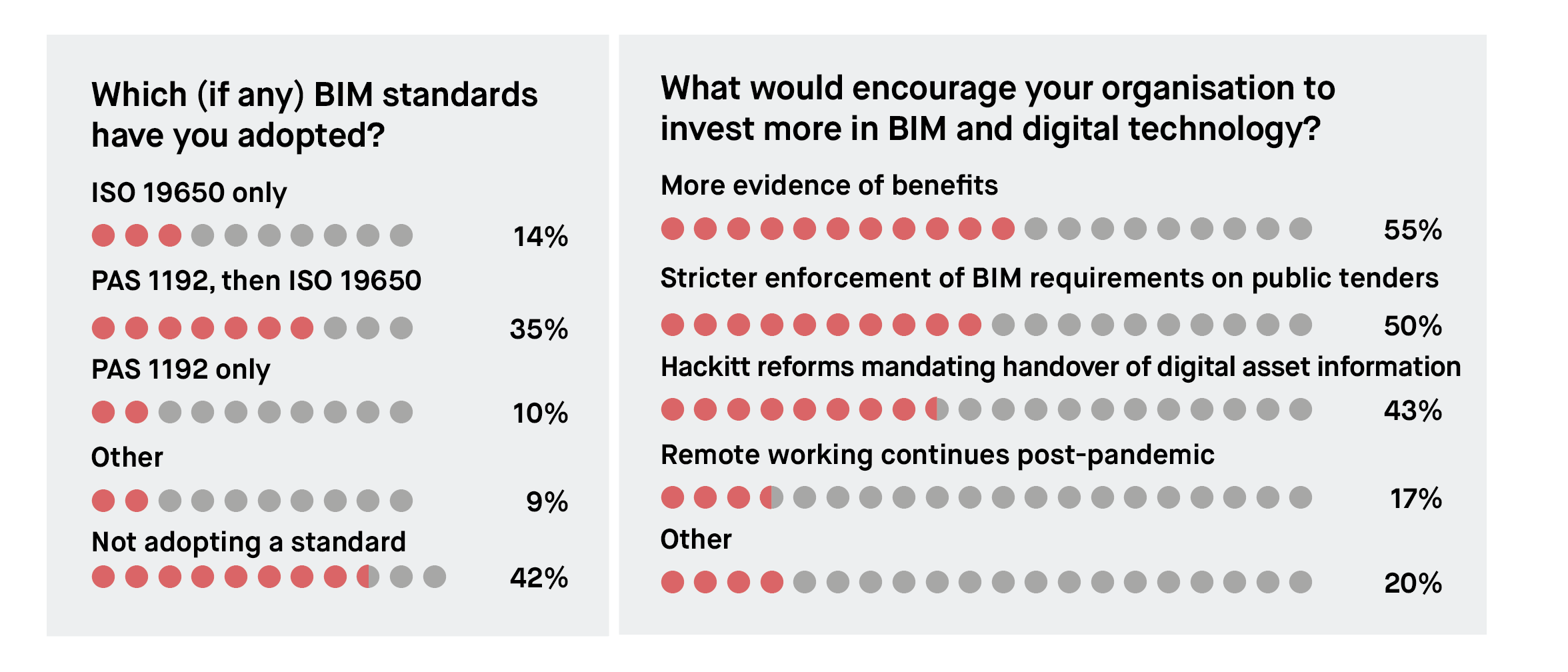

It’s pleasing to note year-on-year improvements in the adoption of BIM standards.

● Since the introduction of the ISO 19650 suite two years ago, 14% of respondents have adopted it, up from 10% in the 2020 survey.

● The percentage still using the PAS 1192 suite decreased slightly from 12% to 10%, while those transitioning from PAS 1192 to ISO 19650 increased from 28% to 35%.

● However, that still leaves a somewhat surprising 42% that have not adopted

a standard, although at least this figure is an improvement on the 51% in the 2020 survey.

So what would encourage organisations to invest more in BIM and digital technology? It seems the ripple effect of the impacts of the pandemic are withering: in last year’s survey in the midst of the first wave of covid, 30% said remote working continuing after the pandemic would be an encouragement; now a year on, with everyone having become used to remote working and the onset of Zoom call fatigue, the percentage choosing this option dropped to 17%.

More than half of respondents (55%) said more evidence of the benefits is required. Nearly as many (50%) said stricter enforcement of BIM requirements in public tenders would do the trick.

The Hackitt reforms mandating the handover of digital asset information was cited by 43%, up from 33% in last year’s survey, perhaps suggesting a wider understanding of the detail of Dame Judith Hackitt’s reforms and their impact.

One respondent said: “The government must stop chasing rainbows – digital twins, etc. – and reinforce BIM Level 2 implementation. ISO does not do it.”

That may be wishful thinking, but with the ‘golden thread’ and initiatives like the government’s Construction Playbook coming into play in the short term, there are grounds to expect adoption to increase at a greater rate.

Respondents

The professionals who responded to our survey conducted in March were drawn from across the UK construction sector, as follows:

● 34% main contractor

● 14% public client

● 11% project manager/QS

● 10% architect

● 10% consulting engineer

● 9% private client

● 9% specialist contractor

● 3% housebuilder

The most popular job titles and roles were:

● 15% BIM manager

● 13% project manager

● 9% QS

● 7% BIM director

● 7% construction manager

● 4% architectural technologist

● 4% building surveyor

● 4% digital construction manager

Organisations they worked for ranged in size from fewer than 20 employees (24%) to more than 1,000 employees (28%).