New construction orders increased at their fastest rate since 1997 in May, according to the latest survey of construction buyers.

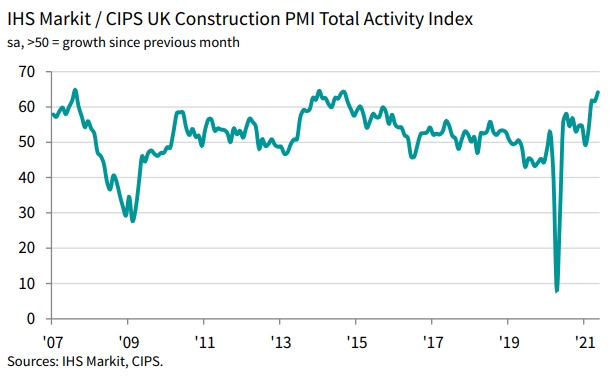

The IHS Markit/CIPS UK Construction PMI Total Activity Index for the month found that output was at its strongest level since September 2014, although input cost inflation was also at a record high, reflecting a surge in demand for construction materials and “severe” supply shortages.

The Index recorded an activity score of 64.2 in May (where 50.0 indicates no change). That was up from 61.6 in April and signalled the strongest rate of output growth for just under seven years.

Housebuilding was the best performing category of construction in May (66.3), followed by commercial work (64.4). The latest increase in commercial work was the steepest since August 2007 as the UK economy begins to re-open. Meanwhile, civil engineering also increased in May (61.3).

Around 47% of the survey panel reported higher volumes of new work, while 11% signalled a reduction.

The rate of job creation was also at the highest level since July 2014 and subcontractor usage increased at a record rate.

But suppliers’ delivery times lengthened sharply in May, while the overall rate of input price inflation was the highest in just over 24 years of data collection.

Construction companies remain “highly upbeat” about their growth prospects for the next 12 months, according to the survey. Around 61% of the survey panel predict a rise in business activity, while just 8% anticipate a decline.

Tim Moore, economics director at IHS Markit, which compiles the survey, said: “UK construction companies reported another month of rapid output growth amid a surge in residential work and the fastest rise in commercial building since August 2007.

“Total new orders increased at the strongest rate since the survey began more than two decades ago, but supply chains once again struggled to keep pace with the rebound in demand.

“There were widespread reports citing shortages of construction materials and wait times from suppliers lengthened considerably in comparison to those seen during April. Imbalanced supply and demand led to survey[1]record increases in both purchasing prices and rates charged by sub-contractors.

“Despite severe challenges with materials availability, construction firms remain highly upbeat about their near[1]term growth prospects. Nearly two-thirds of the survey panel forecast an increase in output during the year ahead, while only one-in-thirteen forecast a decline.”