As an industry highly dependent on fuel, construction should pay close attention to the volatile oil market, says Pablo Cristi Worm.

In our modern world, where innovation is prized and sustainability goals are driving so many shifts and developments, it can be easy to forget that the global economy still relies on oil more than any other commodity.

Though ongoing efforts to reach net zero targets are decreasing our dependence on the black gold, and will continue to do so in the coming years, the reality is that for now it plays a dominant role in transportation and industry.

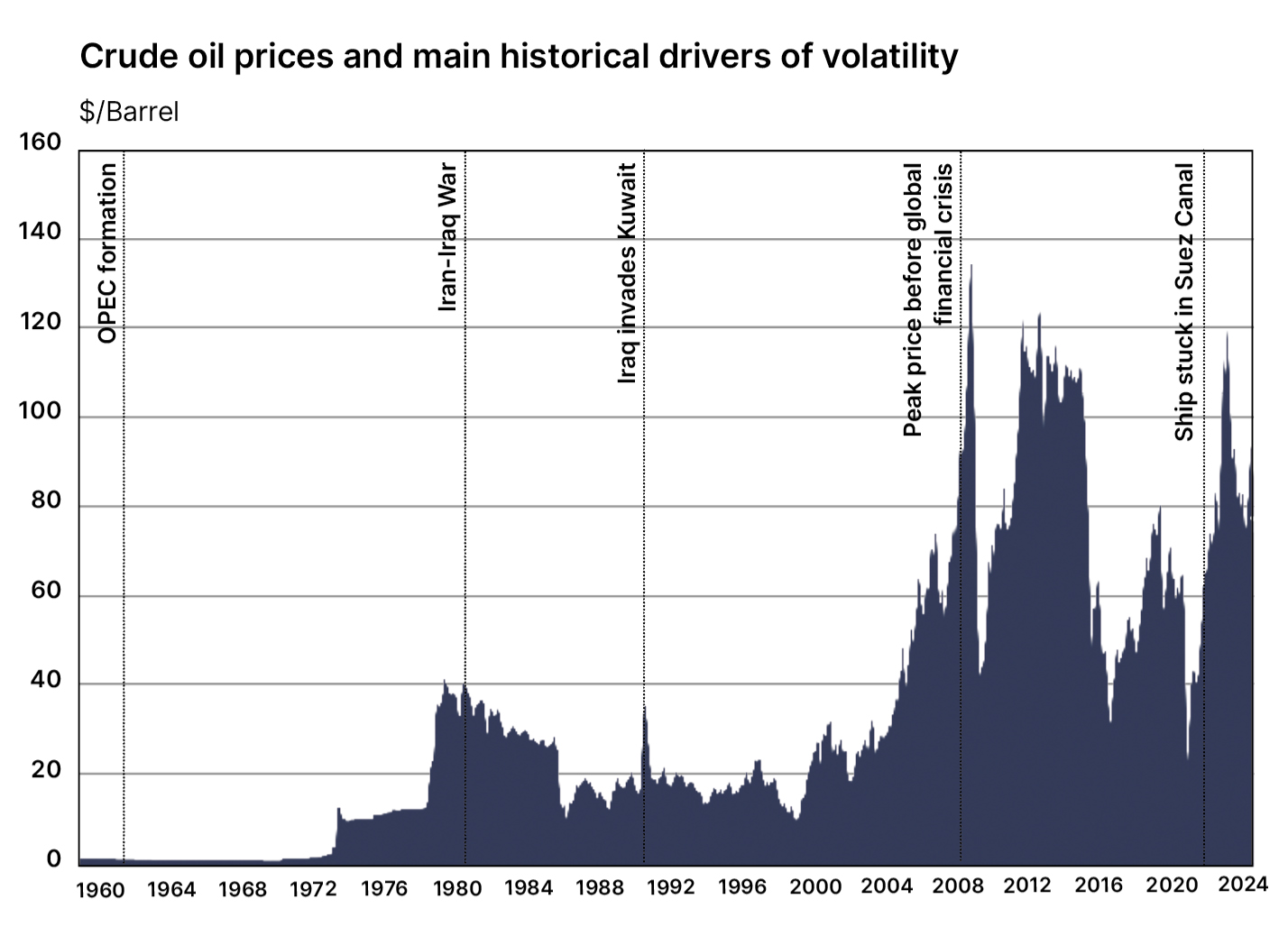

Oil is also one of the world’s most volatile commodities. Many of the key oil-producing regions – the Middle East, Latin America and Russia – are politically turbulent. This increases the risk of regional crises resulting in global oil price fluctuations and impacting economies all over the world.

The price of oil also regularly changes in response to geopolitical events and economic cycles. If economic activity falls sharply, so does demand for oil and its price. In the aftermath of the global financial crisis in 2008, oil prices fell 66.4% from a high of $132 (£104) a barrel. The Covid-19 pandemic had a similar effect – causing a fall of 57.6% in just three months.

The knock-on effect on construction

More recently, global events have seen prices rise, and construction is one of the industries particularly exposed to this volatility. In 2022, the conflict in Ukraine and the economic sanctions on Russia that followed led the cost of oil to surge beyond $120 (£95) per barrel.

While the World Bank currently expects a price fall to $81 (£64) in Q1 2024, it is now warning that an escalation of the conflict in the Middle East could cause prices to reach $150 (£119) per barrel – an all-time historic high.

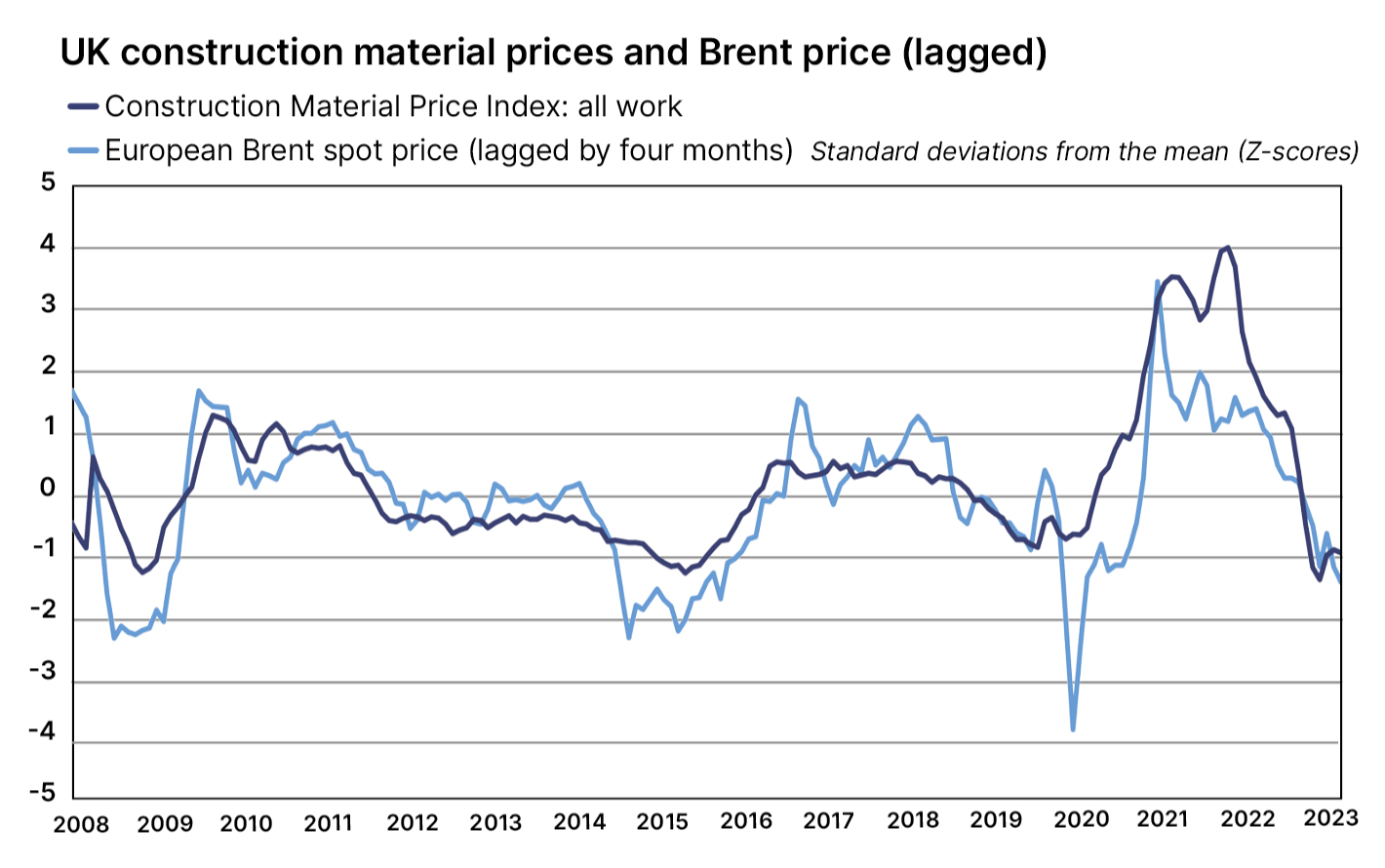

Construction’s exposure to oil prices stems from several factors, including the production, distribution and utilisation of materials. According to Turner & Townsend’s calculations, 80% of fluctuations in construction input costs can be attributed to the volatility of oil and fuel prices.

This is based on the fact that over half of construction’s total expenses originate from materials, plant and preliminary costs, which are sensitive to changing oil and fuel prices. This is particularly true of the fuel-intensive production of concrete, steel and glass, as well as the operation of diesel-using heavy machinery. Imported materials – with their associated fuel needs for transportation – also make up a significant proportion of the price of projects.

Analysis conducted by Turner & Townsend found that variations in oil prices are responsible for 70% of construction material price changes. Fluctuations in the price of oil take, on average, four months to filter through to the sector. This delay should be taken into account by the industry when planning for and undertaking projects, as the full effects of a spike or fall in oil markets may not be immediately felt.

Ending dependence on fuel

Given warnings about potential oil price spikes, how can clients seek to mitigate exposure of projects to this volatility? In the first instance, clients need to identify areas of their supply chain that could be more vulnerable to oil price shocks so these can be reduced – for example, by limiting reliance on imported materials or those with fuel-intensive methods of production.

More energy-efficient processes should be pursued where possible, like modern methods of construction or modular building, to limit projects’ demand for fuel.

In the longer term, part of the solution will be looking to energy sources that trade prices locally rather than globally, reducing the impact of geopolitical events. The situation also reiterates the importance of innovation and investment in alternative and renewable fuels, such as hydrogen – which may deliver more stable and plentiful solutions for the future.

Pablo Cristi Worm is a senior economist at Turner & Townsend.