What lessons can we learn about previous economic downturns? Kris Hudson examines how the current recession may affect the construction industry.

There is no crystal ball to tell how deep or long this recession will be. However, as the UK enters a new downturn, there are lessons to learn for construction from how the sector has fared in previous recessions.

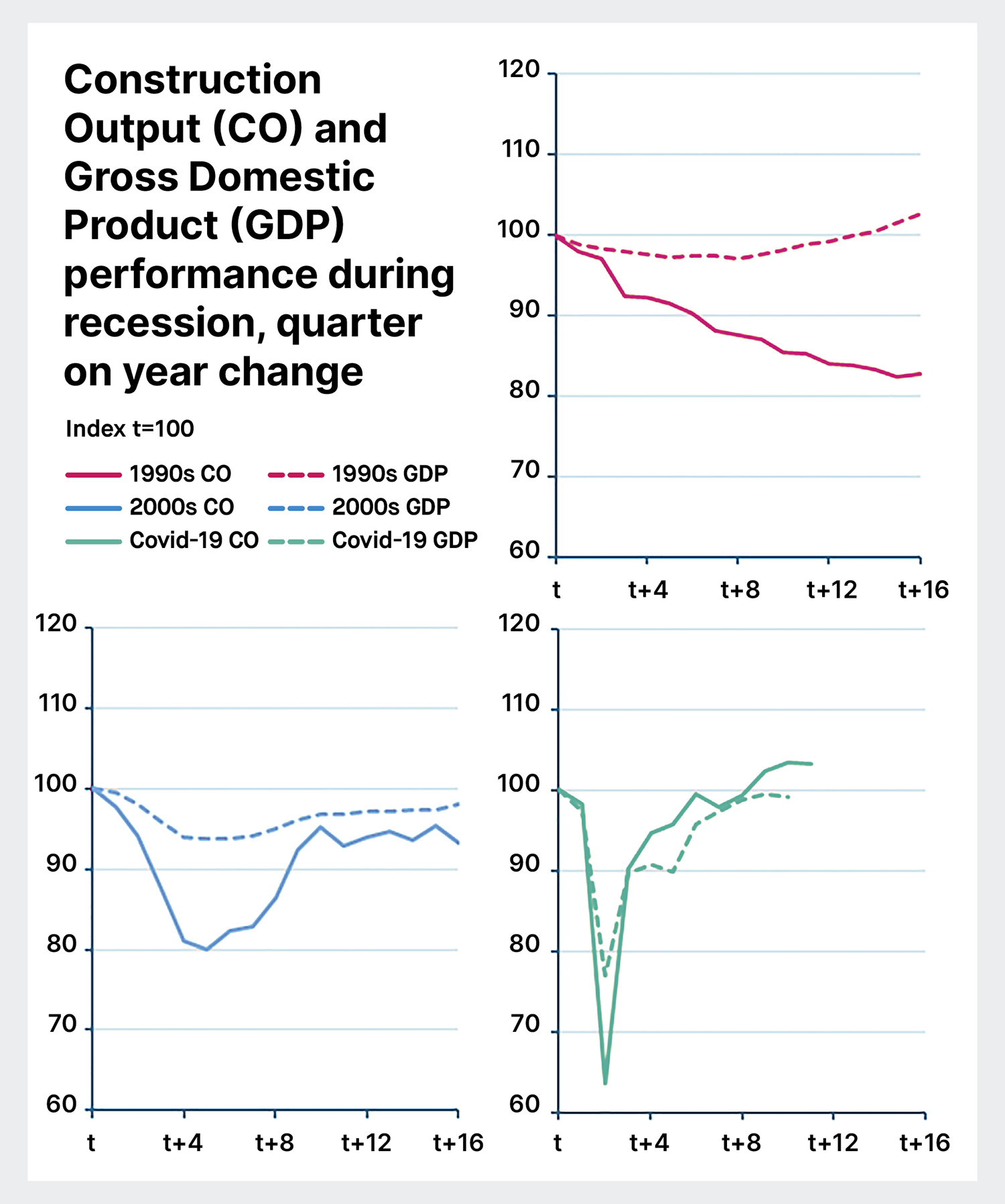

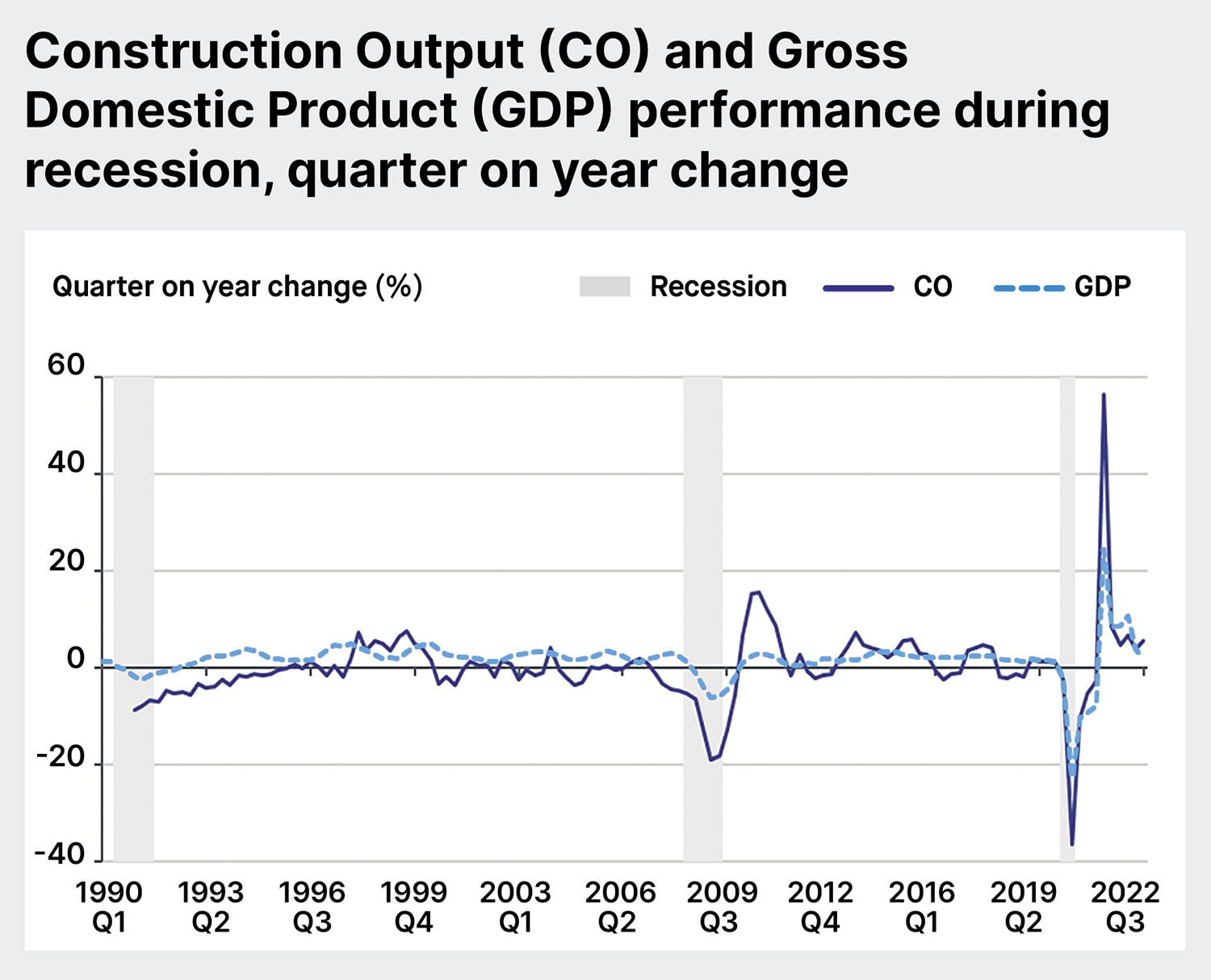

Source: Office for National statistics

In terms of what the ‘typical’ recession might look like, we can analyse data from the Office for National Statistics for every UK downturn from the 1950s to the Global Financial Crisis. Based on this, an average recession contraction lasts for approximately five economic quarters, with a GDP fall of 3.4% from peak to trough, followed by a recovery taking close to 11 quarters.

In all previous downturns where data is available, construction output growth has reduced ahead of recessions. It usually falls more than GDP but grows faster and further afterwards – often providing a key driving force to help sustain economic recovery. For example, in the 2000s recession, quarter on year growth of construction output fell to -19.0% while GDP dropped to only -5.9%. But in the recovery, fortunes reversed, and construction grew to 15.6% against GDP’s 3.1%.

Slowing output delayed

The circumstances of the current recession are different. Pent-up demand – released post-pandemic – has delayed the slowing of construction output growth, which is now falling simultaneously with GDP.

This should not distract the industry from the evidence of previous recessions, as construction output growth is still likely to fall further than GDP. The Office for Budget Responsibility forecasts are that this recession could last just over a year, seeing GDP fall by 2.1% from peak to trough, and potentially recover to its pre-recession level in 2024.

A further challenge is that the current structural problems around low productivity, supply chain disruption, high energy prices and rising interest rates may compromise the industry’s ability to recover. However, firms that have focused on productivity gains in recent years will be well placed to weather the storm.

For those looking to manage the complexities of recession and build project resilience, there are three key areas to focus on. Firstly, take time to tender properly and secure reliable partners. Secondly, pragmatically apportion risk so it is balanced across the client and supply chain. Lastly, keep your supply chain updated with regular, open conversations to identify and mitigate risks.

Kris Hudson is an economist and associate director at Turner & Townsend.