In our latest contract clinic, Chris Jones advises a panicking contractor whose costs are considerably higher than the amount the client wants to pay.

The question

We’ve come to the final account and the employer argues the amount due is substantially lower than our costs, so we need to prepare a claim. We’ve never been in this situation before, so don’t know where to start. What are the key things we need to include?

The answer

Firstly, let’s not jump to conclusions and assume that a claim needs to be prepared. Has a detailed final account submission been drafted and forwarded to the client? Usually, a first draft of an assessment of the final account will be full of differing opinions, assumptions, and potential errors as to what work has, should have, and wasn’t completed. Let’s take stock and provide the employer with all the facts.

If it has been left to the end of the project to seek agreement on all elements of the final account, then it can often be a complicated, time-consuming, and adversarial process, often resulting in disputes.

The process can be made substantially easier if adjustments to the scope of work and ultimately the contract sum are agreed upon as the project progresses rather than saving them up for the end. This is often referred to as a ‘rolling final account’. Rolling final accounts will ensure that all instructions and cost effects to a project are up-to-date and agreed upon at any one point of the contract or the latest financial report.

It is also a less painful process if both the client and contractor or subcontractor work collaboratively on drafts of final accounts before the agreement is sought. Without a well-managed change control process, the final account negotiations may be more difficult, with differences of opinion on what were instructions and what should have been instructed.

Most construction contracts generally provide some mechanism for the final payment to be made to the contractor or subcontractor on completion of the scope of works that have been agreed in the contract and adjustments to the contract sum. Of course, these adjustments would need to be substantiated with contemporaneous records, such as signed daywork sheets, marked-up drawings and photographs.

These two principles are always worth following:

1. Build a claim from day one and hope you won’t have to use it; and

2. Records, records, records!

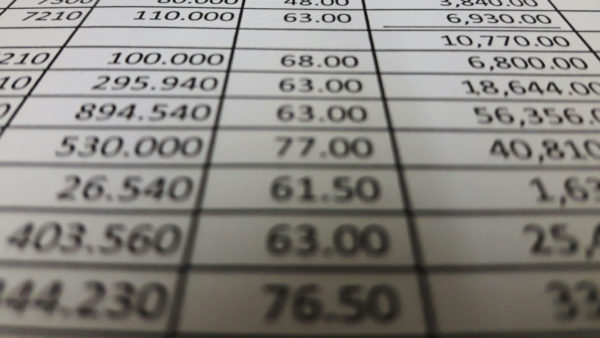

Final account schedule

There is no standard template for a final account schedule. However, it may include (but not be limited to) the following:

- Variable Costs

- Provisional sums

- Approximated quantities

- Prime cost sums

- Day work allowance

- Variations

- Loss and expense

- Fluctuations

- Changes in taxation

- Changes in the cost of labour, transport, and materials

- Contra-charges

- Liquidated and ascertained expenses

As discussed earlier, any result or agreement to values in the final account schedule will only be as good as the backup information and substantiation provided. The substantiation should demonstrate, and evidence, actual works undertaken on site and may include site surveys, site measurements, actual costs incurred, meeting minutes, progress reports, timesheets, and potential entitlement to loss and or expense.

You may find that you must spoon-feed the information to the other party to get a resolution to differences of opinion. The better the information you can provide through good record-keeping, the easier this process will be.

Remember, ‘he who asserts must prove’. Good, complete records, agreed by all concerned, remove the need for speculation, guesswork, and interpretation (or rather misinterpretation) of the facts.

Put simply, records are the evidence that prove your case. A good set of records can be the difference between success and failure.

Chris Jones is a senior consultant at Decipher, A DeSimone Company.

Comments

Comments are closed.

One of the biggest causes of disputes is when work has not been completed to the specified standard and may have to be remedied at the contractors cost.

Keeping records and informing the Client of additional costs, due to changes as the work progresses, may still result in disputes at the final stage as the Client finally realises it has to pay additional sums. Without the ongoing issue of the information to the Client throughout the project duration, though, it is a lot harder to win the argument.

Generally a very helpful article. Arrangements may have moved on since I last produced draft final and final accounts but on a project under a basic JCT Contract eg IFC,the Employer will be bound to pay Sum/s to the Contractor as Certified by the Contract Administrator – The Employer doesn’t have direct authority/powers to influence or control the procedure for arriving at the amount of the Final Account, for obvious reasons,unless both parties reach a separate agreement on any issue such that its effect on the Final Account value can be included within it.

If the Employer raises any objection this would create a dispute which is catered for under a separate Contract provision(best try hard to avoid getting into this situation- costly and time consuming) I would suggest, for clarity, to treat the ”Final Account” figure as covering the “works”as actually completed including all of the effects of certified variations. Thereafter,matters arising such as LAD, would be set against the otherwise agreed FA. Note also: should a Contractor have a legitimate reason to, and actually terminate, before the works are finally completed this will trigger significant differences in the scope of and nature of the (remnant) Contract provisions, affecting the parties’ rights, obligations and powers. Additional considerations and calculations will be required to quantify the outcome of the final sum owed at the date of termination.