The unprecedented fiscal stimulus led to a fall in insolvencies in Q2 – but the full picture may not emerge till next year, says Kris Hudson

With confirmation that the UK is in the grips of a technical recession, should the construction sector be bracing for mass insolvencies?

As a significant indicator of cashflow concerns and potential insolvencies, the latest data on profit warnings makes for stark reading. EY data shows that more FTSE-listed construction and materials companies have issued profit warnings in the first half of 2020 than over the whole of 2008, when the global financial crisis struck.

This is not a paywall. Registration allows us to enhance your experience across Construction Management and ensure we deliver you quality editorial content.

Registering also means you can manage your own CPDs, comments, newsletter sign-ups and privacy settings.

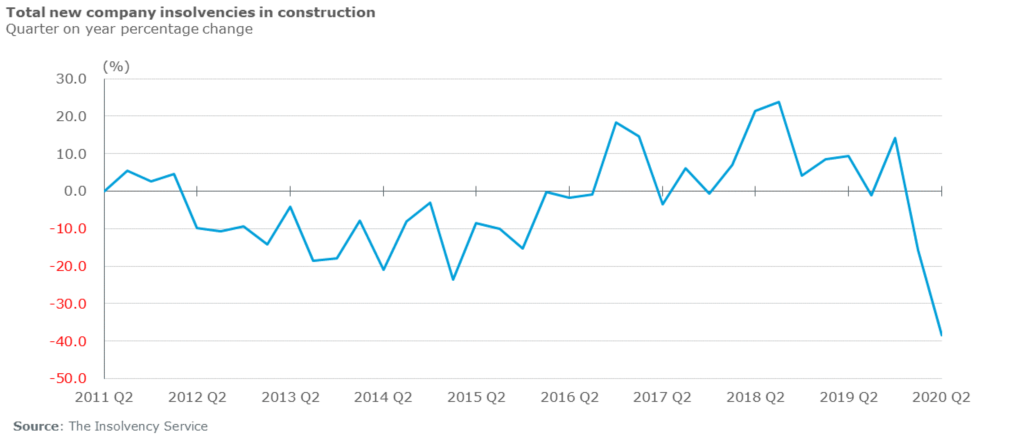

Construction also holds the unenviable title of the industry most affected by insolvencies over the past year, with 2,778 new company insolvencies filed in four quarters to 2020 Q2. Yet insolvencies within construction in the second quarter of 2020 have in fact decreased by 38.4% compared to last year. It is a welcome relief and shows that the unprecedented packages of government support aimed at tackling the coronavirus crisis are having a positive impact.

Graph: Total new company insolvencies in construction

Historic insolvency trends

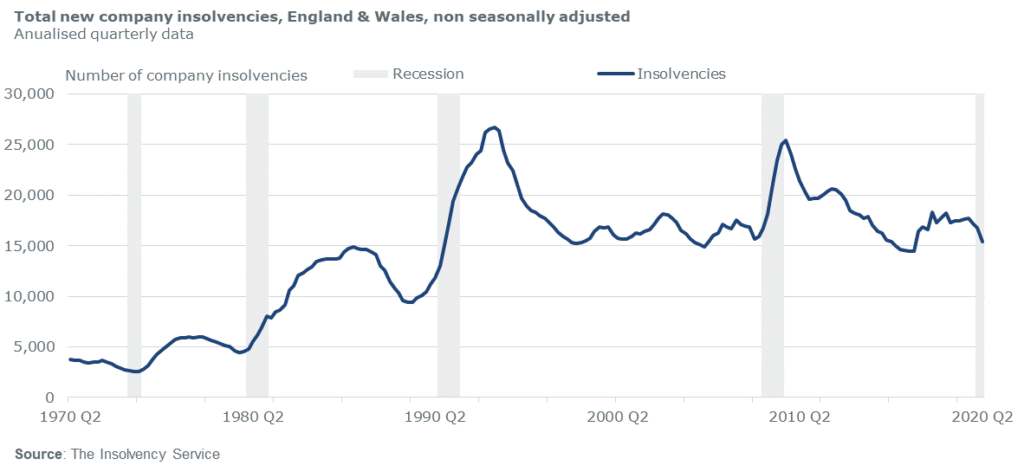

Before the 2008 financial crash, the trend was that following an economic crisis, insolvencies historically increased in line with improved economic growth, peaking after the recession had ended. As growth resumed, prices and overheads picked up, legacy contracts became untenable and rising interest rates started to bite.

This was not the case during the 2008 crash, when insolvencies in fact peaked during the recession, and not afterwards. Increased creditor forbearance, historically low interest rates and a raft of government measures helped stem the tide of belated insolvencies.

Fast forward to 2020 and we’ve now seen insolvencies fall following unprecedented fiscal stimulus.

Graph: Total new company insolvencies, England & Wales, non seasonally adjusted

But the risk is that the furlough scheme, which will begin to taper off this autumn, could be keeping companies afloat that might not otherwise survive. This means we’re unlikely to see the full picture emerge until next year, with insolvency rises still probable thereafter.

To ensure a healthy recovery, and prevent a domino effect of insolvency, it is imperative that the industry comes together to support a new approach to the ‘new normal’. This means staying alert to margin erosion and the capital constraints of suppliers, and ultimately moving closer to delivery models and commercial strategies that prioritise the value drivers of a project rather than piling more pressure on the supply chain.

Collaboration will therefore be key both during and in the aftermath of this covid-19 recession.

Kris Hudson is an economist and associate director at Turner & Townsend