Against the background of a challenging market, rising administrations are an indicator to watch, writes Kris Hudson.

Against the backdrop of rising input costs, supply constraints, and the curtailment of various government support measures, construction insolvencies have climbed in recent months – further demonstrating the deep impact of ongoing market challenges.

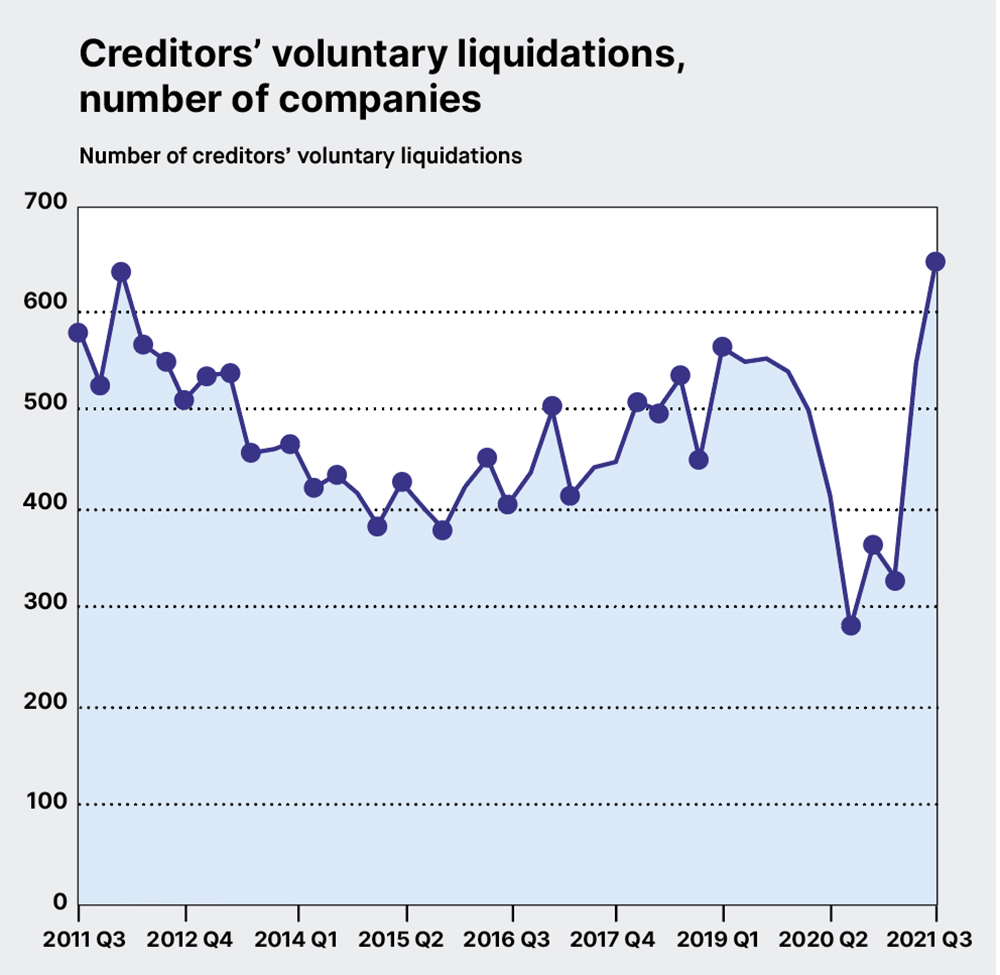

The Insolvency Service reports that in 2021 Q3, new company insolvencies in construction increased by 18.6% on the quarter and 80.2% on the year. Of all insolvencies in the sector, 91.5% correspond to voluntary liquidations, with this type of insolvency representing an even higher 129.8% increase on the year.

Looking beneath the headlines, most insolvencies (59.6%) were from firms that delivered specialised construction activities such as plumbing or electrical installation. Material and component affordability will undoubtedly have played a part, along with extended lead times. This may feed into programme slippage and payment delay, which can concertina and be of particular concern for building completion and finishing trades at the end of the construction process.

We should be cautious about assuming that this spike could become a trend. However, there are signs to be wary of. Figures from Creditsafe show that construction administrations in October 2021 are higher than at any point since March 2020.

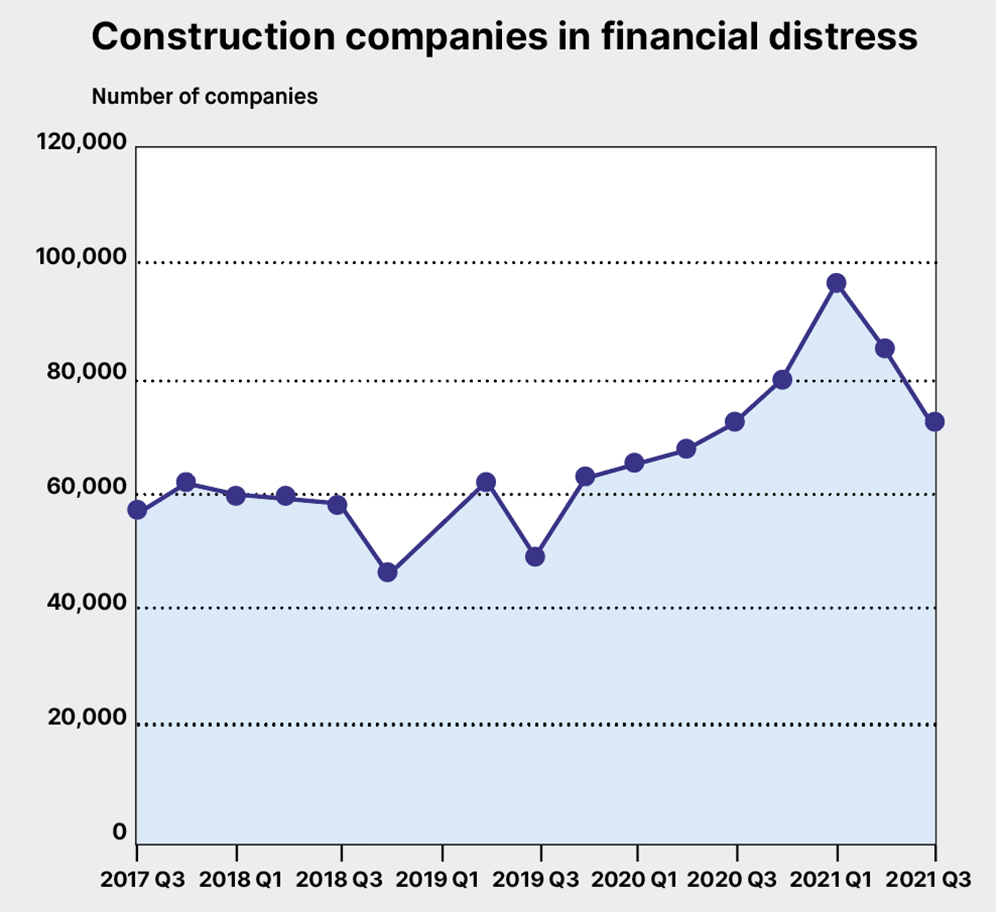

Yet, profit warnings for construction and material companies, reported by EY, have fallen recently. Only one firm has issued a warning in 2021 Q3, unchanged on the quarter and down 80% on the year. Begbies Traynor, a business recovery specialist, reports that the number of companies in financial distress has fallen by -15.1% on the quarter in 2021 Q3.

Nonetheless, with inflationary pressure yet to subside, the number of construction insolvencies in 2022 may be higher than 2021. More insolvencies are likely to have a major impact on the successful delivery of projects. The risk is that works could be left incomplete, significantly delayed, or with costs far exceeding original budgets, which can, in turn, lead to further insolvencies.

Breaking this cycle requires progress with some of the underlying market challenges, which might not happen imminently. Although contractor insolvency can be reduced by taking precautionary steps before entering into contract, such as fair and realistic risk allocation and acceptance, conducting financial stability assessments and focusing on best value, not necessarily price, are a must. However, businesses will remain at risk as supply chains continue to be restricted and this uncertainty persists.

Kris Hudson is an economist and associate director at Turner & Townsend.