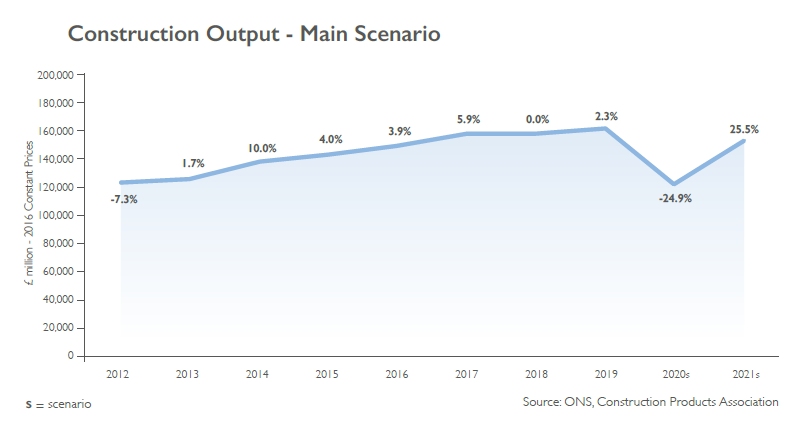

The Construction Products Association (CPA) has warned the construction industry to expect a “long slog ahead” after it predicted a 25% fall in output across Great Britain during 2020 as a result of the coronavirus pandemic.

The anticipated decline in output is one of three scenarios for construction output examined by the CPA.

Even under its most optimistic scenario, the country’s construction activity would suffer its sharpest fall ever recorded, the CPA said.

Around 60% of planned construction work was lost in April as a result of construction work being paused during the coronavirus lockdown to implement social distancing measures.

But the loss in output in April varies across sectors and nations. An estimated 83% of work in Scotland did not take place due to more stringent lockdown measures, 85% of house building output was lost and 60% of non-residential new build was lost.

In the residential repairs, maintenance and improvements sector, around 60% of work was lost, concentrated mainly in the ‘improvements’ element. The non-residential repair and maintenance sector saw only a 20% loss of activity, as work to repair largely un-used buildings and infrastructure such as roads and schools was brought forward.

The CPA’s most optimistic scenario for a recovery in output is based on a ‘V’-shaped recession affecting primarily the second half of March, April and May, followed by a rebound from June at a slower pace than the initial decline. Its other scenarios include a W-shaped recession (a second wave of infection and lockdown in 2020 Q4 and subsequent recovery in 2021 Q1) and a U-shaped recession (continued restrictions throughout 2020 and a slow recovery in 2021 as businesses and consumers come out of it highly risk-averse).

CPA economics director Noble Francis said: “The greatest impacts of the lockdown in construction were seen in the private housing sector. Returns to site in May will focus on partially completed developments rather than new starts as house builders are expected to be very cautious given uncertainty regarding demand. This uncertainty will also keep the recovery muted in commercial offices, industrial factories and the most-severely affected sub-sector, commercial retail.

“A more positive outlook is expected for infrastructure activity thanks to a greater ability to implement safe distancing for workers on larger sites but also, vitally, thanks to HS2 being given the go ahead to proceed. An increase in activity from the five-year investment programmes within regulated sectors such as water and sewerage, roads and rail also adds to this more positive story.

“For the fortunes of construction more generally, though, the near-term effect of Covid-19 on the economy and employment are likely to be considerably greater than those faced during the financial crisis of 2008/09. In addition to these issues around the general economy and construction demand, productivity on site has fallen significantly due to social distancing and other safety, which means that construction activity will take longer and cost more. Even in our most optimistic scenario, construction output bounces back by 25.5% in 2021 but, with growth starting from a low base, output will still be 6% lower than in 2019. Combined with the high levels of uncertainty on demand, getting levels of construction back to pre-Coronavirus levels will take time. Expect a long slog ahead.”