Although input costs are easing, construction clients still need to position themselves as attractive buyers and work collaboratively, writes Pablo Cristi Worm.

After the headwinds construction has faced over the past 12 to 18 months, it is a relief for many that input costs are starting to trend downward as energy and material prices begin to alleviate.

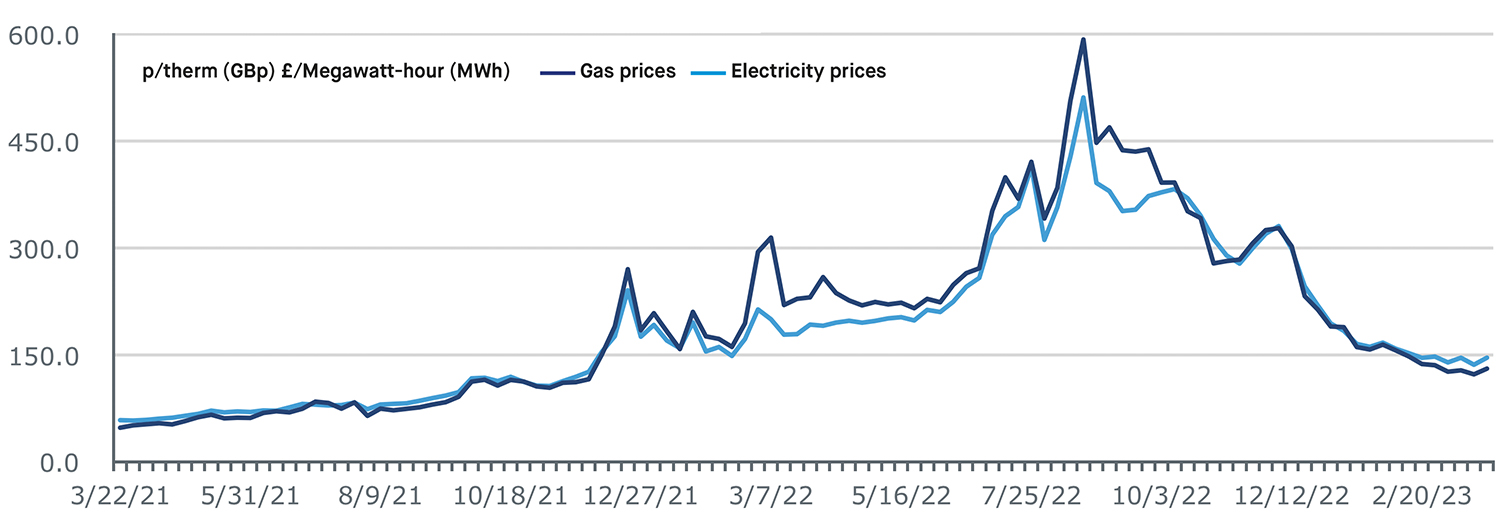

Panic buying in Europe last year, primarily caused by the conflict in Ukraine, drove steep increases in wholesale energy prices in 2022 but the situation has now stabilised. Gas storage is at 85% of EU capacity as spring reduces the need to heat homes and workplaces.

Reduced LNG demand

A milder winter has largely helped to avoid a crisis. Reduced demand for liquified natural gas (LNG) from China, due to lockdown restrictions, has helped moderate global market prices. By extension, this has eased bulk prices in the UK.

For construction, the reduction in energy input costs gives a glimmer of hope that inflationary pressure will lessen. At the same time, construction output is also experiencing a cooldown. The Construction Product Association downgraded its forecast for the construction industry from a fall of 4.7% in its winter report to a decrease of 6.4% in its spring 2023 release.

Gas and electricity prices: forward delivery contracts – weekly average

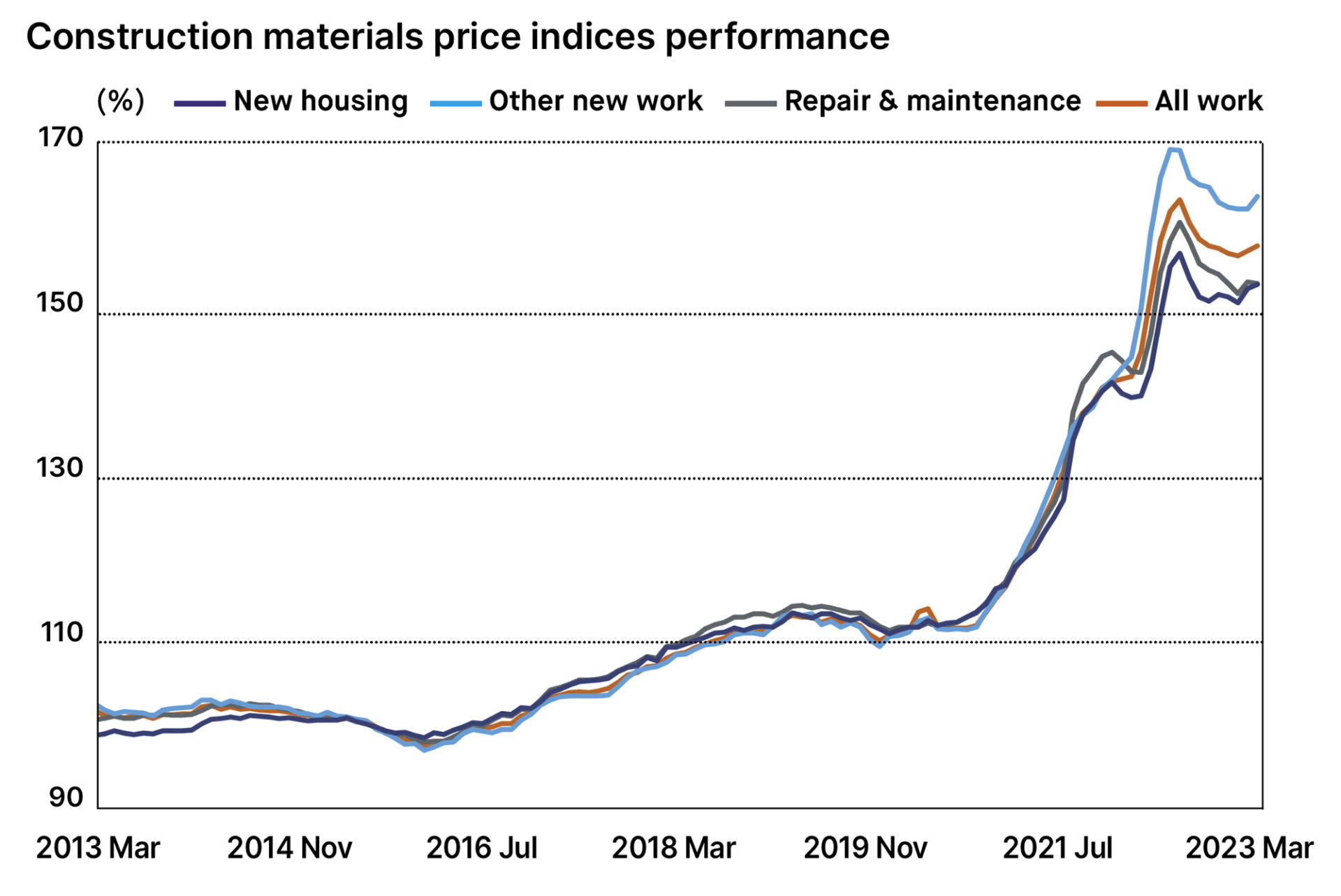

Additionally, the sales of ready-mixed concrete, delivery of bricks and concrete blocks and sales of sand and gravel are all trending downward. Lower input costs and decreasing demand suggest industrywide cost reductions that have long been hoped for could be on the horizon.

Amid a highly volatile geopolitical climate, there are chances that the prices could surge again next winter. Systemic solutions to the energy crisis have not yet fully emerged – while efforts to increase energy efficiency helped bring down prices, supply is still constricted, and major planned LNG projects are not due to be completed until later this decade.

Less uncertainty needed

However, for disinflation to take place, construction – and the economy in general – will need to see less uncertainty. Suppliers are unlikely to be willing to pass on cost reductions to clients while the situation remains turbulent – instead needing to price in the risks and secure their margins. Furthermore, there is some price stickiness as a result of suppliers stocking up at higher prices and not passing those savings on to the supply chain.

The Department for Business and Trade’s (DBT) ‘All Work’ material price index increased by 8.7% on the year in March, down from 10.6% in February. While inflation has decreased, the price of materials continues to rise and is currently 34.9% higher than it was in January 2022, prior to the onset of the Ukraine conflict. Nonetheless, some of the factors that kept wider price inflation high in 2022 are beginning to lose intensity. The World Bank expects commodity prices to fall by 21% in 2023 and remain mostly flat in 2024.

To benefit from the cooling pressure and reductions in costs, clients must acknowledge this is still a supplier’s market and position themselves as attractive buyers. Strong and effective partnerships with a supply chain can be achieved in many ways but may be as simple as paying invoices on time and being transparent in engagement and negotiation.

Clients should take a hands-on approach, talk to suppliers and understand how they can work to balance risk and lower costs together.

By working collaboratively, showing a full understanding of constraints in the market and bringing a willingness to overcome them together, clients will be more likely to achieve better relationships and lower costs.

Pablo Cristi Worm is an economist at Turner & Townsend.