London is among the leaders of the data centre market but capacity, skills and sustainability challenges could jeopardise its status, writes Pablo Cristi Worm.

From everyday technology to groundbreaking artificial intelligence (AI), our use of data is rapidly increasing. This growth is fuelling the expansion of the data centre industry. However, is the UK construction industry prepared to meet the demands this expansion brings?

Turner & Townsend’s Data Centre Cost Index 2023 found that London stands out as Europe’s primary market for data centre expansion, estimated to have reached 1GW of operation capacity at the end of 2023.

Followed by Frankfurt, Amsterdam, Paris and Dublin, London ranks third globally, trailing only Beijing and North Virginia’s long-standing tech cluster. However, challenges regarding power grid capacity, land availability and shortages of skilled mechanical and electrical (M&E) specialised labour may hinder the pace of growth.

Clean energy challenges

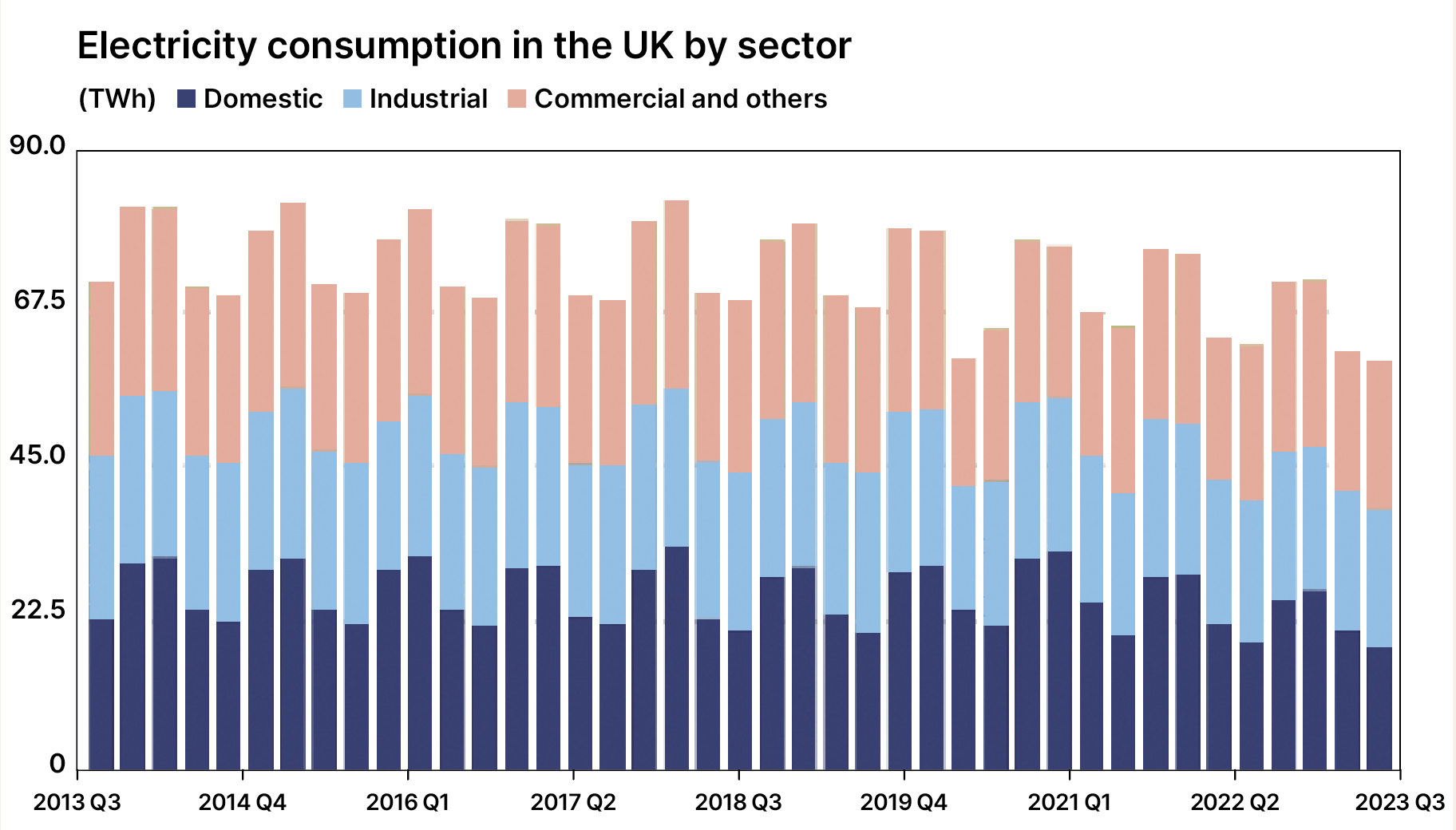

Sustainability concerns about the use of carbon and energy demand also present significant obstacles. Electricity consumption from data centres, AI and the cryptocurrency sector is expected to double globally by 2026. By then, data centres alone will potentially consume over 1,000TWh of electricity worldwide – the equivalent of Japan’s total electricity consumption.

According to a study by the International Energy Agency, the primary drivers of data centres’ electricity demands are the cooling systems and the servers themselves, with each typically accounting for 40% of the total consumption. The remaining 20% is consumed by the power supply system, storage devices and communication equipment.

Over time, regulation and technological advancements are expected to play crucial roles in addressing these challenges. High-efficiency cooling systems have the potential to reduce electricity demand in data centres by 10%, while other research shows that a 20% reduction in consumption can be achieved through innovative water circulation techniques and the integration of low viscous fluids.

Along with the transition to hyperscale data centres, which typically include tens to hundreds of thousands of servers and associated infrastructure, these are key strategies the industry is adopting to reduce electricity demand and promote cleaner forms of power.

An optimistic future outlook

Beyond energy constraints, increased demand is making data centres a victim of their own success when it comes to more recognisable supply chain challenges.

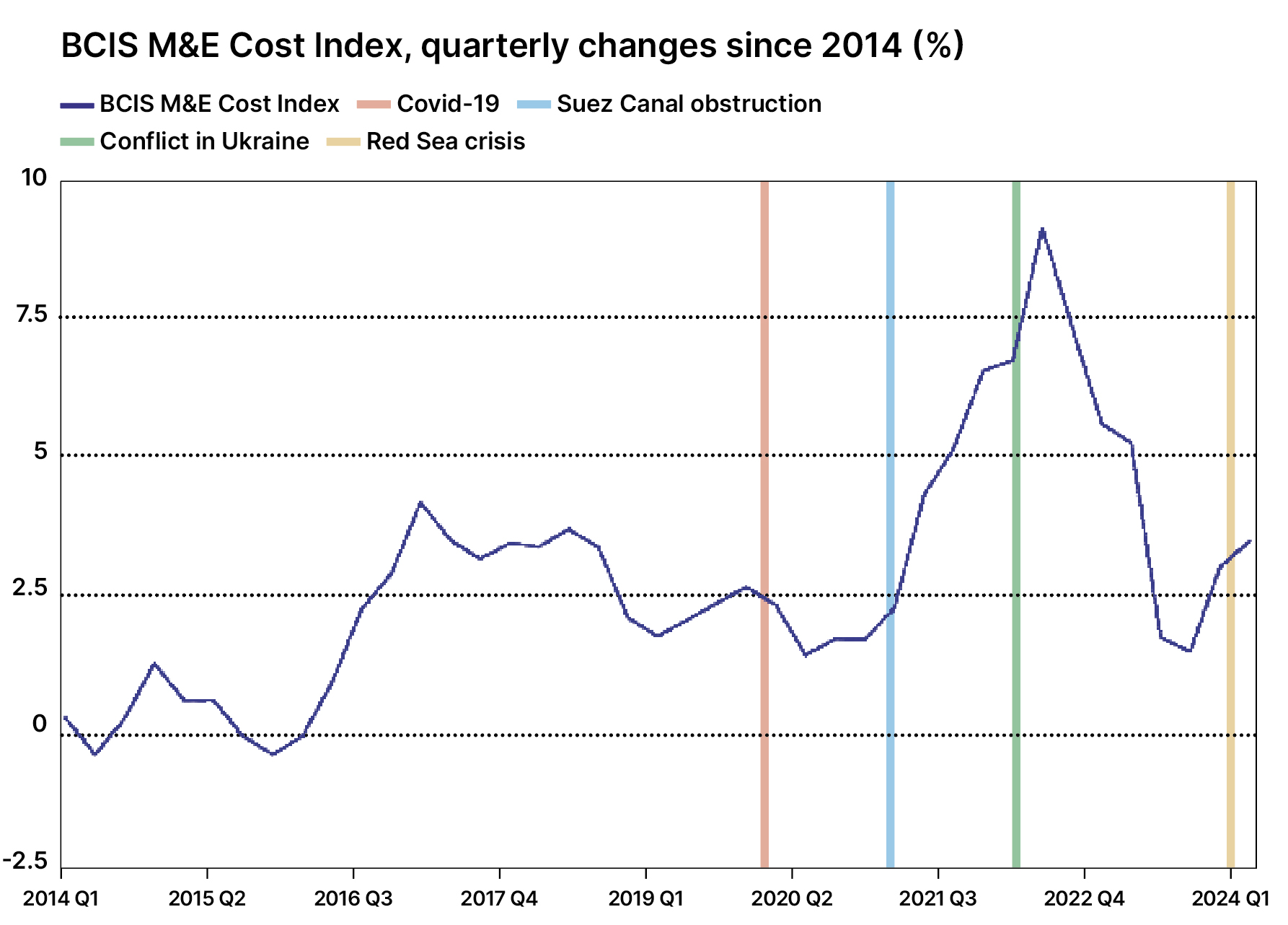

The shortage of skilled M&E contractors, exacerbated by wider economic disruptions, is leading to increased labour costs and longer lead times for equipment and materials. Our data for Q1 2024 shows that some M&E components still show an average of two months of lead-in times, such as generators, chillers, rack mount units and transformers, among others.

Despite these obstacles, the demand for data centre services is not expected to slow. Driven by emerging digital technologies like blockchain and machine learning, several significant data centre projects are in the pipeline across the UK, indicating a healthy long-term outlook for the sector.

Projects such as the Google Data Centre in Hertfordshire, the Echelon LCY20 project and the Segro Park Iver project in Buckinghamshire, are among those expected to contribute to double-digit growth in the sector over the next two years.

To reduce risk and navigate this complex market, clients should explore alternative procurement models. Implementing proactive planning and adopting a portfolio management approach will effectively mitigate lead times by initiating procurement processes at early stages.

Equally, moving away from traditional single general contractor (GC) procurement methods and towards major packages like shell and core or fit out, leveraging a mix of local and international GCs, can enhance project efficiency and flexibility.

Pablo Cristi Worm is a senior economist at Turner & Townsend.