Buyers reported the fastest rise in new construction orders since October 2014 in the latest IHS Markit CIPS UK Construction PMI survey for November.

The figures revealed a “sustained” recovery in UK construction output, with the rate of expansion accelerating from the previous month.

However, employment trends remained relatively weak across the construction sector and the survey warned that stretched supply chains resulted in a sharp increase in average cost burdens.

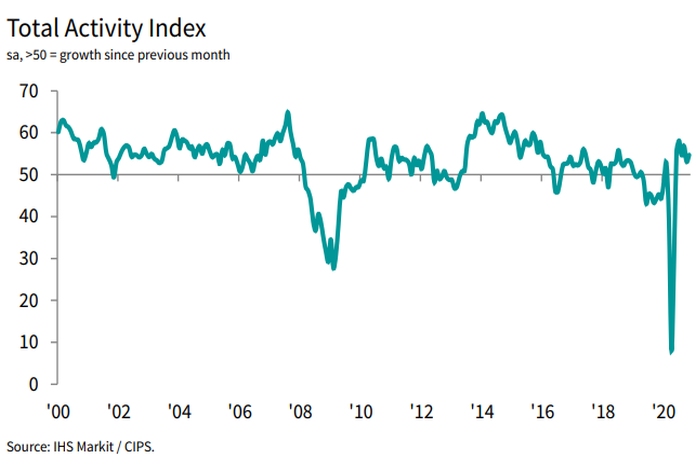

The UK Construction Total Activity Index registered a score of 54.7 in November, up from 53.1 in October (where a score of 50.0 indicates no change).

Construction companies indicated that house building was the best-performing area in November (index at 59.2), despite the rate of growth easing since October. Civil engineering returned to growth in November (52.3), while commercial work increased only marginally (51.9) and at the slowest rate for six months.

New business volumes expanded at a “robust and accelerated pace” during the month November. Buyers attributed the steepest rise in order books since October 2014 to a recovery in tender opportunities and improving confidence among clients.

But rising demand for construction products and materials placed additional pressure on supply chains in November. There was another sharp lengthening of lead-times among vendors and survey respondents often commented on transport delays and stock shortages. Meanwhile, input costs increased at the fastest rate since April 2019, with particularly sharp rises in timber prices.

Despite rising business activity and incoming new work, some firms reported ongoing job cuts amid efforts to reduce overheads. Around 51% of the survey panel forecast a rise in business activity during the year ahead, while only 16% predict a decline.

Tim Moore, economics director at IHS Markit, which compiles the survey, said: “UK construction output stayed on a recovery path in November and there were signs that the main growth driver has transitioned from catch-up work to new projects. The latest increase in new orders was the strongest since late-2014, with construction firms reporting a boost from rising client confidence and the release of budgets that had been held back earlier in the pandemic.

“House building was once again the stand-out performer, while a return to growth for civil engineering contributed to the rise in the headline PMI during November. Commercial construction lagged behind the recovery seen elsewhere in the sector amid subdued demand for office space, retail developments and other corporate projects hit by the pandemic.

“Supply chain challenges remain on the horizon, as signalled by another sharp lengthening of lead times for construction products and materials. Transport delays and low stocks among suppliers were reported by construction firms in November, which led to the fastest increase in purchasing costs for over one-and-a-half years.”

Commenting on the latest findings, Fraser Johns, finance director at Beard, said: “New orders at the highest level since 2014 really demonstrates that confidence is returning, new projects are back on plan and rather than just catching up on ourselves, the construction sector is continuing its recovery.

“Certainly, this reflects our own experience at Beard as we look towards 2021 with a head of work which is very healthy, not only for this year but at any time.

“While this is all cause for optimism, we also need to recognise that there is continued pressure on supply chains currently. That is going to be brought into sharp focus come 1st January if the Brexit talks currently ongoing are not resolved with an agreement of some sort. No industry sector as important to the economy as construction can afford to suffer due to delays at the border while we wait for materials to reach our sites.”