Construction buyers reported a strong increase in construction activity during April, alongside the fastest rise in new orders since September 2014 and the fastest increase in input costs since the survey began in 1997.

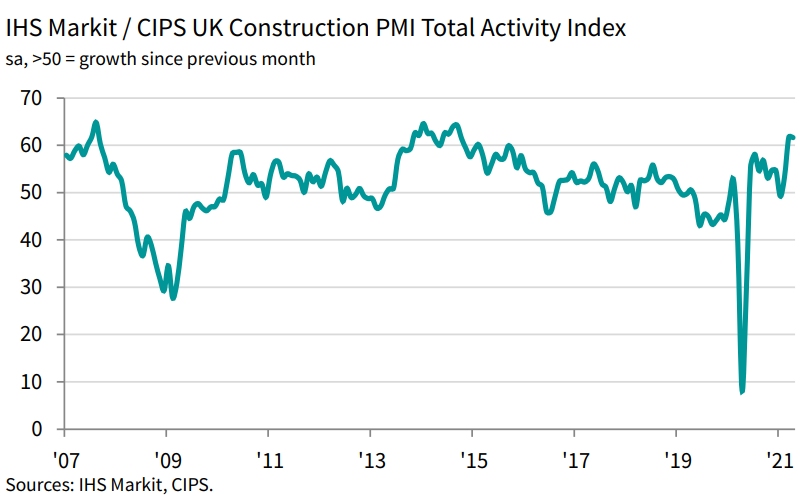

The headline IHS Markit/CIPS UK Construction PMI Total Activity Index posted a score of 61.6 in April, down slightly from 61.7 in March (where any figure above 50 indicates growth in activity).

Commercial activity was the best performing category in construction in April (62.2), while civil engineering (61.5) signalled its fastest speed of recovery since September 2014. House building (61.2) also rose in April, albeit down slightly from its March peak (64).

New orders were at their strongest level in six and a half years, while the rate of job creation was at its steepest since December 2015.

But the survey also warned that a rapid rise in demand for construction products and materials was stretching supply chains. The latest lengthening of suppliers’ delivery times was the third-greatest since the survey began in 1997, exceeded only by those seen in the lockdown in April and May. Construction firms mostly cited supply and demand imbalances but some suggested Brexit issues had led to delays on inputs arriving from the EU.

But companies remained upbeat about their growth prospects in April, with more than half (57% expecting a rise in business activity during the next 12 months and only 7% forecasting a decline.

Tim Moore, economics director at IHS Markit, which compiles the survey, said: “The UK construction sector is experiencing its strongest growth phase for six-and-a-half years, with the recovery now evenly balanced across the house building, commercial and civil engineering categories.

“New orders surged higher in April as the end of lockdown spurred contract awards on previously delayed commercial development projects. This added to the spike in workloads from robust housing demand and the delivery of major infrastructure programmes such as HS2.

“Shortages of construction materials and much longer wait times for deliveries from suppliers were a sting in the tail for the sector. Aggregates, timber, steel, cement and concrete products were all widely reported as in short supply by survey respondents.

“Supply and demand imbalances for construction items, alongside higher transport costs, resulted in severe price pressures across the board during April. The overall rate of input cost inflation reached its fastest since data collection began 24 years ago, exceeding the previous record seen at the top of the global commodity price cycle in 2008.”